1989 – In his 2nd start following treatment for a cancerous tumor in his pitching arm, Dave Dravecky of the league leading San Fransisco Giants breaks his arm while throwing a pitch to Tim Raines. Dravecky later retires from baseball after breaking his arm a second time during the Giants celebration following their pennant clinching victory, and will eventually have his left arm and shoulder entirely amputated. He is currently an author and motivational speaker. (The video of the break is out there, but it is included with some other gruesome injuries you probably don’t want to see.)

1979 – Francis Ford Coppola’s Apocalypse Now is released in theaters. Beset by all kinds of production problems including a change in the lead after one week of shooting (Harvey Keital as Willard was quickly dropped by Coppola), a heart attack in mid-film (Martin Sheen), unprepared starring actors (an overweight Marlon Brando ad libbed most of his role since he didn’t know his lines), and weather problems (a typhoon destroyed several of the sets), production costs soared and the release date was postponed several times. Coppola himself suffered a nervous breakdown. Still, the film was met with critical acclaim and garnered 6 Academy Award nominations, winning for Best Cinematography and Best Sound. Coppola later released a documentary of the making of the film, taken largely from home movies filmed by his wife, called Hearts of Darkness: A Filmmaker’s Apocalypse.

1969 – The Woodstock Music and Art Festival, advertised as “3 days of peace and music”, opens on the grounds of Max Yasgur’s dairy farm in Bethel, New York on Friday, August 15. Although Bethel permit authorities are told to expect no more than 50,000 people, some 186,000 tickets are sold prior to the event. Unable to manage security for the expected numbers, the events organizers decide at the last minute to open the gates for free admittance, and at its peak about 400,000 people are in attendance. Thirty three different bands are scheduled to appear, including some of the top performers of the day such as Arlo Guthrie, Joan Baez, The Grateful Dead, Janis Joplin, The Who, Jefferson Airplane, and CSN&Y. The concert becomes a defining event of the 1960’s and the decade’s youth culture. The final act, former army paratropper Jimi Hendrix, finished up Monday morning and included this now historic nod to his country.

1945 – Japan’s Emperor Hirohito takes to the radio for the first time ever and announces Japan’s unconditional surrender. This is the first time his voice has ever been heard by the vast majority of Japanese citizens. Noting that “the enemy has begun to employ a new and most cruel bomb, the power of which to do damage is, indeed, incalculable”, the Emperor says that “Should we continue to fight, it would not only result in an ultimate collapse and obliteration of the Japanese nation, but also it would lead to the total extinction of human civilization.” Although Japan’s official surrender will not be signed until early September, August 14-15 (US/Japan time zones) is generally accepted as V-J Day.

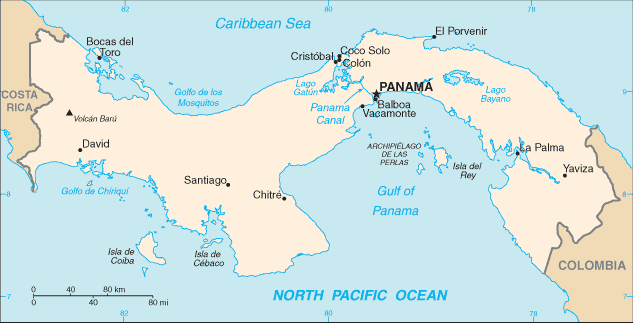

1914 – After 30 years of of digging, first by the French and later by the US, the Panama Canal is officially opened to commercial traffic, cutting the time it takes ships to travel from the Atlantic Ocean to the Pacific Ocean in half. While the canal was originally completed and owned by the United States, it reverted back to Panamanian control in 1999. Interestingly, owing to the geography of Panama, traveling through the canal from the Atlantic to the Pacific will have one traveling eastward, not westward.

Famous Birthdays – Napoleon Bonaparte (1769), T.E. Lawrence (1888), Julia Child (1912), Ben Affleck (1972)

Filed under: This Day in History | 29 Comments »