Vital Statistics:

| Last | Change | Percent | |

| S&P Futures | 1550.2 | 3.4 | 0.22% |

| Eurostoxx Index | 2696.2 | -9.3 | -0.34% |

| Oil (WTI) | 93.9 | 0.2 | 0.17% |

| LIBOR | 0.282 | 0.002 | 0.71% |

| US Dollar Index (DXY) | 82.66 | -0.032 | -0.04% |

| 10 Year Govt Bond Yield | 1.94% | -0.02% | |

| RPX Composite Real Estate Index | 192.6 | -0.2 |

Markets are firmer this morning in spite of the continuing problems in Cyprus. The FOMC meeting starts today, with the rate decision expected tomorrow. The market will be focusing on the Fed’s body language regarding the strength of the recovery and the end of QE. Bonds and MBS are up on the flight to quality trade.

Housing starts climbed to a 917,000 annual rate in February. Muti-fam starts continue to be in the 36% – 37% range as builders feed the red-hot rental market. Housing starts are still running at about 60% of historic levels (about 1.5MM units) going back to the late 50s. For the past 10 years, we have averaged 1.3 million units a year, which includes the meat of the housing bubble and the bust. We have been underbuilding for some time now.

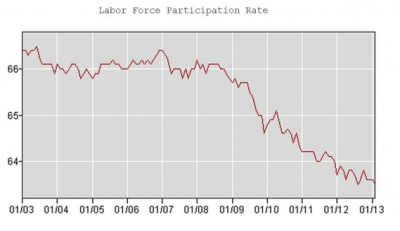

The fact that we have underbuilt for so long partially explains why the rental market is so hot. This demand was masked for quite some time due to the recession as household formation numbers plummeted.

Many would-be first time homebuyers graduated college and returned to their parents’ house after an unsuccessful job search. Others moved in with roommates to minimize costs. That drop in household formations does not represent a demographic shift, it represents a temporary economic phenomenon. It also means there is a lot of pent-up demand that is going to be released as the economy recovers. While a lot of that will go into rentals, the first time homebuyer (creditors willing of course) is about to return to the housing market and that will allow the move-up buyer to sell. This has been one of the biggest sticking points for the market – a lack of first-time homebuyers.

So, with this economic backdrop, why did the homebuilders report a drop in confidence last month? The National Association of Home Builders / Wells Fargo Housing Market Index of builder sentiment had been on a tear since early 2012 as the homebuilders began sticking their heads above the parapet. The problem is not demand for new homes; it is problems in the the supply chain, along with rising costs for materials and labor. In an earlier post, I talked about how the shortage of construction workers was making lives difficult for homebuilders. This is reflected in the builder sentiment survey. They also mention the gripe everyone else is making – appraisals – and a tough credit market for borrowers who don’t fit in the GSE / GNMA box.

Bottom line: if you have made a bit of dosh trading the homeboys or the XHB, it might be time to start ringing the register….

Filed under: Morning Report | 44 Comments »