Vital Statistics:

| Last | Change | |

| S&P futures | 4,163 | 32.50 |

| Oil (WTI) | 77.61 | -0.86 |

| 10 year government bond yield | 3.59% | |

| 30 year fixed rate mortgage | 6.30% |

Stocks are up this morning on positive earnings. Bonds and MBS are up.

Initial Jobless Claims rose to 196,000 last week. This comports with the jobs report last Friday.

New York City is the most “rent-burdened” MSA out there, with people paying 69% of their income in rent. In order to NOT be considered rent-burdened, you have to make $177k. Other MSAs include Miami, Fort Lauderdale and Los Angeles.

Rithm Capital (aka New Rez) reported earnings yesterday. Mortgage origination volume fell 43% QOQ and 80% YOY to $7.9 billion. The company is guiding for Q123 volume to fall further to $5 – 7 billion. On the plus side, gain on sale margins rose 10 bp QOQ and 16 bp YOY to 1.81%. Funds available for distribution came in at $0.33, so the $0.25 dividend is well-covered at least for now.

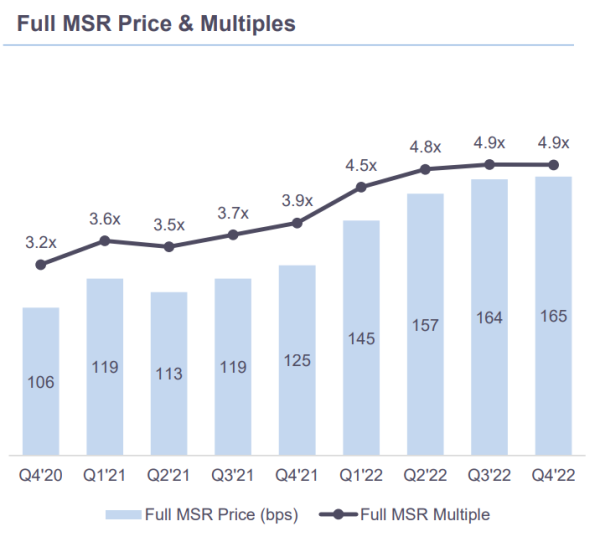

The servicing portfolio has been the engine of growth, but it looks like they are valuing their portfolio pretty much fully at 4.9x servicing revenue.

Rithm is also building other businesses including single family rentals and its reno / construction / bridge loan businesses.

PennyMac Mortgage Investment Trust got beat up in the fourth quarter, as origination income fell. Note where they are valuing their servicing portfolio:

6.1 times is pretty hefty, and with their origination volume at 50% government, I wonder how much is FHA. Government servicing is not trading at 6 times. The MSR market is pretty well-supplied with originators selling their servicing portfolios to raise cash. I have to imagine the actual secondary market is well below that regardless of size.

Filed under: Economy |

Brent, you may find this of interest:

LikeLike

I suspect an aging population also explains the changes.

LikeLike

I’m going to have to check this out:

LikeLike

Foreign countries are getting into the “send them to DC” act:

“Nicaragua frees more than 200 political prisoners, sends them to Washington”

https://www.politico.com/news/2023/02/09/nicaragua-frees-more-than-200-political-prisoners-00082080

LikeLike

One writer at the Atlantic gets it:

“A Qualified Defense of Christopher Rufo

New College is not a weak target, and if Rufo wants to challenge an entrenched bureaucracy, then he will have a fair fight.

By Graeme Wood”

https://www.theatlantic.com/ideas/archive/2023/02/christopher-rufo-manhattan-institute/673008/

LikeLike