Vital Statistics:

| Last | Change | |

| S&P futures | 3,948 | -15.25 |

| Oil (WTI) | 71.93 | 0.43 |

| 10 year government bond yield | 3.53% | |

| 30 year fixed rate mortgage | 6.35% |

Stocks are lower after the Producer Price Index came in hotter than expected. Bonds and MBS are down.

Inflation at the wholesale level picked up in November, according to the BLS. The Producer Price index rose 0.3% MOM and 7.3% YOY, which was driven primarily by final demand servicers, which is basically wages. The PPI ex-food and energy rose 0.3% MOM and 6.2% YOY. This report is one of the last pieces of data before the Fed meets next week.

Consumer sentiment improved in the early part of December, according to the University of Michigan Consumer Sentiment Index. All three components improved on a MOM basis, but are still lower than a year ago. This probably reflects falling gasoline prices – these consumer confidence indices generally correlate negatively with gas prices.

Inflationary expectations eased again, which is good news for the Fed. Inflation expectations hit a 15 month low, but are still higher than a couple of years ago.

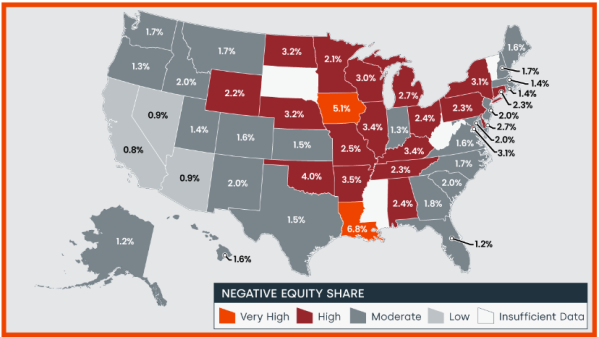

Home equity increased 15.8% YOY in the third quarter, according to data from CoreLogic. This works out to be about a $34,300 gain on the average mortgaged home. Negative equity is still an issue in the Midwest and Northeast.

“At 43.6%, the average U.S. loan-to-value (LTV) ratio is only slightly higher than in the past two quarters and still significantly lower than the 71.3% LTV seen moving into the Great Recession in the first quarter of 2010. Therefore, today’s homeowners are in a much better position to weather the current housing slowdown and a potential recession than they were 12 years ago. Weakening housing demand and the resulting decline in home prices since the spring’s peak reduced annual home equity gains and pushed an additional number of properties underwater in the third quarter. Nevertheless, while these negative impacts are concentrated in Western states such as California, homeowners with a mortgage there still average more than $580,000 in home equity.”

Filed under: Economy |

Good read:

“People are upset that PVC or SPF or DMC or whatever his name is hasn’t been charged and arrested yet. I’ve been asked to explain, in a diplomatic and respectful way, why this might be.”

https://threadreaderapp.com/thread/1600877380683280384.html

LikeLike

Popehat may be right, but he also sounds like a complete asshole. He also seems unaware of how politicized the current justice department is, and so doesn’t seem to appreciate that suspicions about it giving special treatment to a big Democratic donor is not exactly a beyond the pale notion that only a complete imbecile might take seriously.

LikeLike

here’s the thing i think about: how long did the government go after frank quattrone?

LikeLike

In the case of SPF, I think they would actually be more likely to go after him given how public the failure is.

I don’t see those contributions buying much loyalty in the current circumstances.

LikeLike

jnc:

I don’t see those contributions buying much loyalty in the current circumstances.

I’ll bet you $100 that he gets treated better by the FBI/Justice Department than, say, Mark Houck.

https://nypost.com/2022/09/29/wife-of-pro-life-activist-mark-houck-speaks-out-after-fbi-arrest/

LikeLike

Taibbi’s latest:

“The Twitter Files

THE REMOVAL OF DONALD TRUMP

Part One: October 2020-January 6th”

https://threadreaderapp.com/thread/1601352083617505281.html

& update on Substack:

https://taibbi.substack.com/p/note-to-readers-on-the-twitter-files

LikeLike

The next part:

https://threadreaderapp.com/thread/1601720455005511680.html

LikeLike

Taibbi, Weiss and Shellenberger were great choices

LikeLike

Surely this neo-racist program is illegal. And yet it is being “expanded” rather than already having been shut down. WTF is going on?

https://sf.gov/news/program-providing-basic-income-black-pregnant-women-expands-help-mothers-across-state

LikeLike

Realistically, what judge is going to bar this?

LikeLike

I can’t imagine a judge (other than perhaps the Wise Latina) not barring it. It seems to me to be about as obvious a Civil Rights Act violation as one can imagine.

LikeLike

I guess I’m not alone in thinking this is obviously illegal.

https://freebeacon.com/latest-news/universal-basic-income-hits-the-bay-area-if-youre-black/

The blueprint for these programs comes from private philanthropic ventures, which have experimented with supplemental income schemes in Jackson, Miss., and Atlanta that are only available to black women.

Though both the Mississippi program, underwritten by the W.K. Kellogg foundation, and the Atlanta program, funded by the Georgia Resilience and Opportunity Fund, discriminate based on race, they probably don’t violate any laws, said David Bernstein, a professor of constitutional law at George Mason Law School.

But their California counterparts are another ball game.

“The publicly funded programs are clearly unconstitutional,” Bernstein said. “It’s not a close call.“

LikeLike

FYI Scott:

https://www.washingtonpost.com/politics/2022/12/12/stephen-miller-america-first-legal-biden-race-policies/

LikeLike

jnc:

FYI Scott:

It’s good to see the existence of such a legal organization. But that article was a masterclass in how modern American journalism has become little more than activist propaganda. Truly amazing.

LikeLike

It truly was amazing. This article would have made a Mother Jones author blush 5 years ago.

LikeLike

This sounds like a likely explanation:

LikeLike

The commentary and headline are annoying, but the interview transcript is interesting.

https://slate.com/news-and-politics/2022/12/federalist-society-judge-william-pryor-interview.html

LikeLike