Vital Statistics:

| Last | Change | |

| S&P futures | 4,203 | 5.2 |

| Oil (WTI) | 124.76 | 5.59 |

| 10 year government bond yield | 1.86% | |

| 30 year fixed rate mortgage | 4.10% |

Stocks are higher this morning after yesterday’s bloodbath. Bond and MBS are down.

Bonds are subject to a push-pull situation, where investors on one hand are buying in the flight-to-safety trade, while others are selling because of inflation.

Home prices rose 19.1% YOY in January, according to CoreLogic. Home price appreciation is expected to slow to 3.8% this year, as a result of rising rates. Given the supply chain shortages and rising input costs, new homes are taking longer to build, which does little to mitigate the massive supply / demand imbalance. Inventory is at a generational low.

Nearly 6,000 homes have sold at prices $100,000 over asking price this year. January was a highly competitive month, where 70% of home sales had bidding wars.

“The housing market was in a frenzy in the beginning of 2022, with buyers competing for a limited supply of homes and sellers reaping the rewards of bid-up prices,” said Redfin Deputy Chief Economist Taylor Marr. “Buyers are likely to face strong competition at least through the next few months as demand is buoyed by the temporary drop in mortgage rates fueled by the Russian invasion of Ukraine. But bidding wars may ease a bit by summer as more new listings come on the market and mortgage rates resume their rise. Homes are still likely to sell above list price, but the premiums will probably be lower.”

Tappable equity in US homes hit a 16 year high, according to Black Knight Financial Services. Home prices have been on a tear, and borrowers have been using cash-outs to refinance credit card debt and other liabilities. Last year, approximately $1.2 trillion of loans were cash-out refinances. About $275 billion in home equity was extracted in 2021, and that should continue.

Does this massive amount of equity extraction set us up for another 2006 debacle? Probably not. Post-cash out LTVs are about 10 points lower than they were in the bad old days.

Plus, real estate bubbles don’t come around that often. Prior to 2006 the previous bubble was during the 1920s. Bubbles are largely psychological phenomenons which require buy-in from everyone involved: lenders, buyers, regulators, etc. The memories of 2006 are too fresh for that to re-occur and the market fundamentals of supply and demand are not in place.

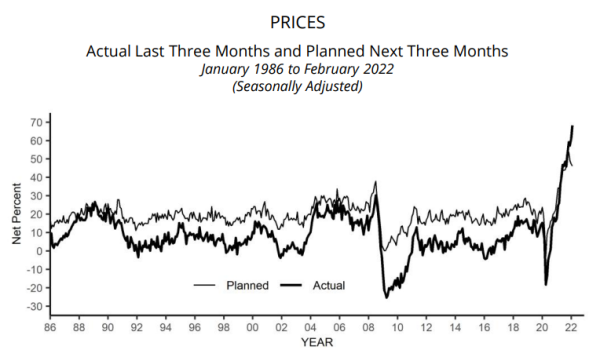

Small business optimism fell again in January, according to the NFIB. Price-raising activity is back to levels not seen since the early days of the Reagan Administration. This is the second month where small business optimism fell below the half-century average. A net 45% of small businesses reported raising compensation, which was a touch below December’s record 48%.

Note that price controls, a vestige of central planning and occasionally used in the US are making a comeback. This has always been a disastrous policy, since price controls create shortages and create black markets. The Biden Administration is already jawboning energy companies about price gouging, and as prices continue to rise, expect to see more of this.

Filed under: Economy |

Another take on Ukraine:

https://mattbivens.substack.com/p/when-ukraine-was-mightier-than-china?s=w&utm_medium=email

LikeLike

The comments here are something.

https://www.dailykos.com/stories/2022/3/8/2084650/-Biden-bans-Russian-oil-imports-calling-it-another-powerful-blow-to-Putin-s-war-machine#comment_83083430

LikeLike

This is the perfect observation:

LikeLike

jnc:

This is the perfect observation:

That is really good.

LikeLike

Low-level common decency would suggest that if you demand a specific course of action from a political opponent, you don’t then attack them for the foreseeable consequences of doing what you demanded.

Tell that to GHWB, who compromised on tax hikes and Bill Clinton shoved it up his keister.

LikeLike

They suspect that deep down the average American isn’t as willing to sacrifice their own standard of living as much as Blue checkmark Twitter is willing to sacrifice the average American’s standard of living.

LikeLike

It is easy to not care about gas prices when you live in Brooklyn or San Francisco.

LikeLike

It’s not even “don’t care”. They actively want them to go higher.

LikeLiked by 1 person

Aint their money

LikeLiked by 1 person

Yeah, this was me. My bad. Sorry guys.

LikeLiked by 1 person

You’ve really shifted if you’re now following Cernovich. How far behind will you be to following Jack Probosiec?

LikeLiked by 1 person

I’m not on Twitter per se, I just read certain writers incognito and this was one of the retweets.

And the Jack Probosiec tweets recently have been interesting too, but a little conspiracy minded for me. I don’t think all of this was instigated as a plan to raise gas prices.

LikeLiked by 1 person

jnc:

I don’t think all of this was instigated as a plan to raise gas prices.

No, but never let a crisis go to waste and all that.

LikeLike

“No, but never let a crisis go to waste and all that.”

Oh yeah, I can totally see that.

LikeLike

Or, I could be wrong:

LikeLike

Marjorie Taylor Greene bought American oil stocks, $CVX, war stocks, $LMT, and renewable energy stocks, $NEE, ONE DAY before the invasion and also tweeting:

“War and rumors of war is incredibly profitable and convenient.”

Hah! They are all the same.

LikeLike

“I don’t think all of this was instigated as a plan to raise gas prices.”

I’m not a big conspiracy theorist, either (I don’t think) but I do believe large events have many inputs–and so I suspect there are folks participating the instigation who see the raising of gas prices as a primary goal. But the problem with the vast conspiracy concept is that everyone would have to be more-or-less on the same page, where as I tend to suspect a lot of people moving towards a similar goal with sometimes vastly different motivations.

Current events have impacts on all sorts of things. Some likely advocate for positions out of principal, others on tangential principals (moving forward the cause of green energy, for example), others entirely on profit (moving stock or currency markets), others for who will owe them something afterwards, should events proceed in a certain direction.

I think singular conspiracy theories fail when they require multiple powerful actors and hundreds or thousands of smaller actors all to be intentionally working in concert. Too many different incentives.

Conspiracies tend to be smaller and require careful curation to avoid exposure (think Journo-list, for example). And participants often don’t think of themselves as doing anything remote nefarious, or that they are in a conspiracy at all (think Journo-list, for example).

LikeLike

Really? I didn’t remotely see that as a possible outcome. And while I guessed it would suck and we would stop being a net energy exporter … this has been worse than I would have guessed.

Although I anticipated he’d be worse than Obama or Bill Clinton … I thought he’d be in that ball park. But I’m not sure anybody was really foreseeing this. At least with Trump you could expect him to start a panic by saying something stupid … so a known quantity.

Eh, it is what it is.

LikeLike

The only member of the Squad who actually walks the walk.

She also voted against increasing the Capitol Police budget after 1/6.

LikeLike

Especially recently. She’s certainly been the most consistent. If she wasn’t such an overt antisemite I could at least respect her. 😉

LikeLike

This made me laugh.

LikeLiked by 1 person

I’m really surprised at how few civilian casualties we’ve seen.

Stunned really.

LikeLiked by 1 person

Oh, be patient. Soon enough.

LikeLike

Norms restored.

https://townhall.com/tipsheet/mattvespa/2022/03/08/joe-biden-trips-over-his-tongue-during-texas-trip-to-expand-veterans-health-benefits-n2604300

LikeLike

Maybe a path to a truce?

https://www.yahoo.com/news/ukraines-zelensky-says-cooled-joining-181721289.html

LikeLike

Just listened to yesterdays Ben Shapiro. He played a clip of Trump telling Germany exactly what the results of their growing dependence on Russian energy would mean, and that it was a bad idea because Russian had expansionist leanings (implying, I expect, that energy dependence on Russia would be used against Germany to pursue those expansionist tendencies).

Trump laid it out at the UN and the German delegation laughed at him while he did it. Turned out he was 100% right … but as the media ponders weighty matters or January 6th and potential criminal prosecution of Trump, they won’t cover that.

Bah.

LikeLike

Shapiro also went over how not Biden not only rolled back Trump’s expansion of drilling and oil leases to the pre-Trump era, the Biden admin has been actively slow-rolling new lease auctions and apparently his admin has greenlit fewer new leases than any previous administration? And just generally working up until the present, and still doing so, to reduce the production of energy via oil and natural gas more than any previous presidential administration.

It’s like they are trying to figure out how to give Random Republican Candidate in 2024 a Reagan style landslide with basically New York, DC, and California voting for the Democrat.

Assuming the GOP can point this sort of stuff out and connect it to inflation, supply chain problems, etc. Which is a big assumption. I fully expect the GOP to focus on the evils of gay marriage in 2024 because they always have their finger on the pulse of the nation.

LikeLike

I suspect the GOP will blow a lot of seats due to the Graham/Cheney caucus of Permanent War. Intervention in Ukraine is only popular among the college educated – for whatever reason – and deeply unpopular among minorities and the working class whites.

LikeLike

Russia / Ukraine is a proxy war for trump and the left

LikeLike

“Intervention in Ukraine is only popular among the college educated – for whatever reason – ”

Adam Smith on this:

LikeLike

The problem with additional drilling is that ESG investors have made it impossible to raise capital for E&P projects. The AZ AG is suing them for antitrust violations

https://www.wsj.com/articles/esg-may-be-an-antitrust-violation-climate-activism-energy-prices-401k-retirement-investment-political-agenda-coordinated-influence-11646594807

LikeLike

Savage.

https://babylonbee.com/news/joining-the-fight-hillary-vows-to-stop-importing-dossiers-from-russia

LikeLike