Vital Statistics:

| Last | Change | |

| S&P futures | 4,349 | -1.2 |

| Oil (WTI) | 70.44 | 0.25 |

| 10 year government bond yield | 1.27% | |

| 30 year fixed rate mortgage | 3.04% |

Stocks are flat this morning after initial jobless claims rose. Bonds and MBS are down.

Initial Jobless Claims ticked up to 419,000 last week, which was well above expectations. I feel like a broken record, but it is surprising to see such elevated initial claims when it seem like every business has a “help wanted” sign in its window.

Existing Home Sales rose 1.4% in June, according to NAR. “Supply has modestly improved in recent months due to more housing starts and existing homeowners listing their homes, all of which has resulted in an uptick in sales,” said Lawrence Yun, NAR’s chief economist. “Home sales continue to run at a pace above the rate seen before the pandemic.” Inventory for sale was 1.25 million units, which works out to be a 2.6 month supply. Six months’ worth of inventory is generally considered to be a balanced market. The median home price rose 23.4% compared to a year ago. Last year’s prices were impacted by the COVID-19 lockdowns, so this rate of inflation is probably overstated and should have an asterisk next to it.

Mortgage applications fell 4% last week as purchases fell 6% and refis fell 3%. “The 10-year Treasury yield dropped sharply last week, in part due to investors becoming more concerned about the spread of COVID variants and their impact on global economic growth. There were mixed changes in mortgage rates as a result, with the 30-year fixed rate increasing slightly to 3.11 percent after two weeks of declines. Other surveyed rates moved lower, with the 15-year fixed rate loan, used by around 20 percent of refinance borrowers, decreasing to 2.46 percent – the lowest level since January 2021,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “On a seasonally adjusted basis compared to the July 4th holiday week, mortgage applications were lower across the board, with purchase applications back to near their lowest levels since May 2020. Limited inventory and higher prices are keeping some prospective homebuyers out of the market. Refinance activity fell over the week, but because rates have stayed relatively low, the pace of applications was close to its highest level since early May 2021.”

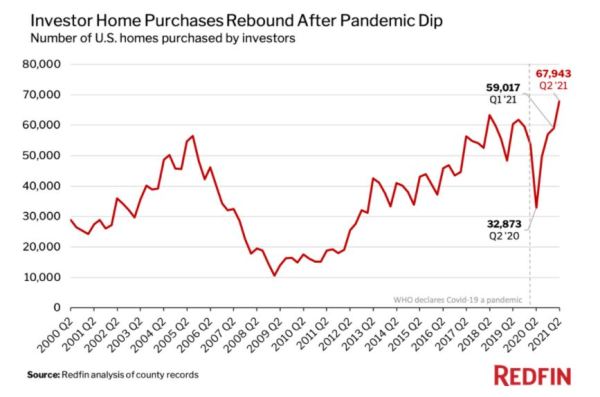

Investor purchases are at a record, according to Redfin. With low rates and rapid home price appreciation, it seems like every private equity firm is raising capital to compete with the likes of Invitation Homes and American Homes 4 Rent. This is putting additional pressure on the first time homebuyer, who is struggling to compete with cash-only bids. The lower-priced tier is also the most popular for the pros, which creates additional issues.

Speaking of rentals, single-family rents increased 6.6% YOY, according to CoreLogic. Surprisingly, rent inflation at the higher-priced tier is faster than the lower priced tier. I am wondering if that is due to eviction moratoriums and landlords forgoing rent increases to keep families in homes.

Filed under: Economy, Morning Report |

The Cheney’s always had big balls.

LikeLike

Our entitled elites think we’re all idiots. They are only half right!

LikeLike

Nobody outside of the left is going to GAF about this.

LikeLike

The rest of the House Republicans should refuse to participate.

LikeLike

I suspect this will be as big of a dud as Iran-Contra was.

LikeLike

But not for lack of trying by the Washington Post and NYT.

On the other hand, the trials and news about people actually going to jail may have an impact.

LikeLike

I suspect this will be as big of a dud as Iran-Contra was

I dunno about Iran-Contra. Ollie North made those hearings something special. 😉

LikeLike

Eric Garner was unavailable for comment.

LikeLike

This is an interesting issue. I expect a lot of potential opposition won’t want to run on this as an issue, so won’t be trying to inform the electorate why they can no longer get their grape cigarillos for blunts and menthol cigarettes but I’m not sure that’s going to be a positive for her in the next election.

LikeLike