Vital Statistics:

| Last | Change | |

| S&P futures | 3916 | 16.4 |

| Oil (WTI) | 59.33 | 1.57 |

| 10 year government bond yield | 1.63% | |

| 30 year fixed rate mortgage | 3.30% |

Stocks are higher despite a lousy durable goods number. Bonds and MBS are up small.

Durable Goods orders fell 1.1% in February, which was well below the consensus estimate of 0.8% growth. Ex-transportation, they fell 0.9% and core capital goods orders (sort of a proxy for business capital investment) fell 0.8%.

Mortgage applications fell 2.5% last week as rates spiked. Purchases increased 3%, while refinances fell 5%. “The 30-year fixed mortgage rate increased to 3.36 percent last week and has now risen 50 basis points since the beginning of the year, in turn shutting off refinance incentives for many borrowers,” said Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting. “Refinance activity dropped to its slowest pace since September 2020, with declines in both conventional and government applications. Mortgage rates have moved higher in tandem with Treasury yields, as the outlook for the U.S. economy continues to improve amidst the faster vaccine rollout and states easing pandemic-related restrictions.”

While refis are falling, we are still well above where we were pre-COVID. Below is a chart of the MBA refinance index.

The MBA sent a letter to Treasury Secretary Janet Yellen and FHFA Director Mark Calibria urging them to reconsider the GSE purchase caps. The MBA expressed concern about the limit on high risk (low FICO / high LTV) caps of 6% on purchases and 3% on refis. It also discussed the problem with investor property caps.

MBA said when the amendments to the PSPAs were announced, Treasury noted that these limits were “aligned with [the Enterprises’] current levels” of investment property and second home acquisitions. Market volumes in these segments in 2020, however, were lower than in prior years, and data from recent months suggest that heightened sales and refinance activity in these segments is driving an increase in GSE acquisitions of these loans. As the GSEs have begun to implement the investor/2nd home caps in the past week, the market for these loans has deteriorated significantly as investors impose loan level price adjustments to avoid getting an excessive volume of loans that the GSEs cannot purchase. It is not clear that private market participants currently have the capacity or resources to absorb the entirety of the gap between the GSE limits and the volume needed to satisfy underlying demand.

At least for the low FICO / high LTV paper, there is an alternative outlet: FHA. For investment properties we are starting to see some investor interest in AUS compliant / non-guaranteed investor property loans. That said, this is a completely new product and there have yet to be any securitizations of this. One potential issue is the capital treatment that banks will have on these. If these loans require higher reserves than traditional Fan and Fred MBS, then banks will be reluctant to hold them and that will affect pricing.

The MBA’s point is a good one, that these loans were artificially depressed as a percentage of all loans in 2020 due to the plethora of easy primary refinances. At a minimum, the MBA is urging FHFA to slow down: “Under a more flexible approach and timeline, the Enterprises could make necessary adjustments to their automated underwriting systems, which would alleviate concerns about existing loan pipelines and better protect against market disruptions. Gradual changes also would provide time for private capital alternatives to develop the operational capacity to serve these market segments.”

The typical mortgage originator did $1.5 billion in the fourth quarter and made 137 basis points.Posted on

Filed under: Economy, Morning Report |

George, I am operating from old memory about this, but you may recall.

Recent [typical bad news emphasis] reporting suggested that the Gulf Coast refineries were purposely slowing production even though margins are now positive.

My old recollection is that this is the time of year that Baytown, etc., switch over to summer blending and that there is always a correlated production slowdown as winter blend is allowed to be depleted.

Ring a bell?

LikeLike

Yes, it does slow down due to the changeover to summer blend. A lot of plants haven’t been running at full capacity for almost a year due to lower demand and I’m not sure how efficient the ramp up will be either. Turnarounds are down but is that due to less plant stress requiring less maintenance or because of cost saving efforts by manufacturers?

https://www.reuters.com/article/us-refineries-operations-turnarounds/lack-of-overhauls-at-u-s-refiners-could-stall-industry-recovery-idUSKBN2A42UH

LikeLike

Thanks.

LikeLike

White suburban women are the worst.

Seriously.

LikeLike

The progressive left is in the process of (a) eating itself and (b) alienating everybody. But reading the comments . . . I mean, sure, some are fine, but Twitter really is just a cancer. I spend a minute reading comments and I want that minute back.

LikeLike

Worth noting:

“Biden administration eyes extended ban on renter evictions as stimulus delays, landlord lawsuits loom

By Tony Romm and Lena H. Sun

March 24, 2021 at 6:00 a.m. EDT”

https://www.washingtonpost.com/us-policy/2021/03/24/biden-renter-eviction-moratorium/

LikeLike

rumor in the industry that the foreclosure / eviction moratorium gets extended to 3/31/22

LikeLike

Twitter is a cancer. But maybe not so much because of Twitter but because of the kinds of people Twitter attracts:

https://notthebee.com/article/here-are-some-knee-jerk-reactions-from-twitter-users-after-the-co-shooting

The NotTheBee article above is right on the money, IMO.

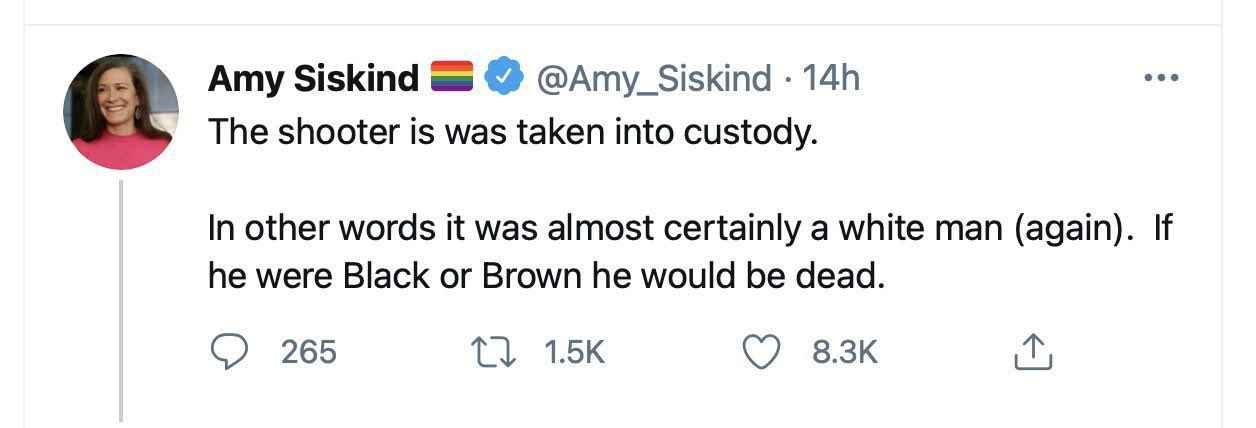

… and this kind of thinking is just idiotic.

And this:

LikeLike

These people run our government, media, and culture.

LikeLiked by 1 person

Yes, they do. And often more than one at the same time, as I’m pretty positive USA Today is basically run by the CIA (or has so many people in it that it might as well be).

LikeLike

@brentnyitray: This speaks to what you were saying about being unable to the left.

Woke blue-check before the report:

…aaand after:

I have a hard time thinking of that as representing any kind of good faith.

The people arguing this means we need more gun control can definitely be acting in good faith. People saying “this is white terrorism, white people are the problem” when they think it was a white guy and then “let’s stop talking about this” when it turns out he was Muslim are not operating in good faith.

LikeLike

How liberal white men are comfortable with being othered like this is beyond me.

LikeLike

I think that they think it helps them get laid.

LikeLike

ugh.

can you imagine being married to any of these women?

LikeLike

I hear you but if you live in the northeast or Pacific coast, that’s the water you have to swim in. You can fight the tide or mouth the platitudes.

LikeLike

these dudes need to start peeing standing up.

LikeLike

“mouth the platitudes”

I read that as “mount the prostitutes.”

LikeLike

They think “oh, they aren’t talking about ME! Yes, I know I’m a white man, but I don’t do wrongthink. I’m super-woke! So it’s not really about me, mostly. In fact I hate white people, too! Damn white people.”

LikeLike

Perhaps, but man do you need to have a total lack of self-respect to buy into it.

LikeLike

I agree. Alas its where we’re at. I liked the whole “we’re all equal” and “don’t judge people by group membership but as individuals” but apparently we can’t do that any more so . . .

LikeLike

apparently we can’t do that any more

Who’s gonna stop me?

LikeLike

Mark:

Who’s gonna stop me?

Your employer, if you have one. Your school administration, if you are in academia. The federal government, if Joe Biden gets his way.

You should really watch the video that Brent linked to yesterday. It is not an isolated event.

LikeLike

Fascinating interview on the current social justice climate.

LikeLike