Vital Statistics:

| Last | Change | |

| S&P futures | 2669 | 20.4 |

| Oil (WTI) | 23.86 | 0.49 |

| 10 year government bond yield | 0.75% | |

| 30 year fixed rate mortgage | 3.47% |

Stocks are higher this morning the Trump Administration works to get the economy going again. Bonds and MBS are flat.

With the Fannie 2.5 over 104, the margin calls are back. The NY Fed needs to take a break.

The government is starting to work on getting the economy re-opened in the next four to eight weeks. The idea would be to start opening up areas which never really had too many cases to begin with, and slowly work everyone back in. Larry Kudlow said: “It’s the health people that are going to drive the medical-related decisions,” National Economic Council Director Larry Kudlow said in an interview with Politico webcast on Tuesday. “But I still believe, hopefully and maybe prayerfully, that in the next four to eight weeks we will be able to reopen the economy, and that the power of the virus will be substantially reduced and we will be able to flatten the curve.”

We will get the FOMC minutes out at 2:00 pm today. Usually the FOMC minutes are a non-event but today could be different. Of course MBS are marching to their own (NY Fed) drummer these days and are gently rising regardless of how the bond market is trading. At a minimum, it will make interesting reading.

Mortgage applications decreased 18% last week as purchases fell 19% and refis fell 12%. FWIW, pricing in the secondary market has been terrible for the past two weeks and that is flowing through to primary markets. Aggregators are pricing like they don’t want the business.

Mark Calabria said that no Fannie / Freddie servicing facility is going to be made available.

“Yes and no is the answer,” Calabria told HousingWire when asked whether FHFA has a plan similar to that of Ginnie Mae, which recently announced a program to aid servicers dealing with forbearance on loans backed by the Federal Housing Administration, Department of Agriculture, and the Department of Veterans Affairs.

“The yes is we continue to monitor Fannie and Freddie servicers,” Calabria said. “We are, at this point, comfortable with our ability to deal with any servicers that may be distressed so that we can either turn them into subservicers or transfer their servicing to other parties. And we believe at this point, given the number on uptake of forbearance, we’ve seen that we can transfer servicing in a way that’s not too disruptive.

“So, the yes is we have contingency plans and procedures put in place were this distress to happen,” Calabria continued. “So that’s the yes part. The no part is, do we have a liquidity facility that we will be providing via Fannie and Freddie? The answer’s no. We don’t have the resources at Fannie and Freddie to do that.”

Calabria is making a bet that forbearance requests will come in around 2% of servicing portfolios, noting the MBA said that 1.7% requested forbearance in a sample. Of course that was the first week, so it probably is premature to say that is the number. But he isn’t buying the 25% estimates some are throwing around, at least for non-Ginnie servicers. For Ginnie servicers, he can buy that number. FWIW, this kind of feels like a Lehman Brothers moment for the servicers.

Well, this news isn’t doing anything for servicing in the bulk market. I heard that Fannie Mae servicing trading at 1x- 2x. Freddie is 1x and GNMA is 1x to negative. In normal markets, Ginnie is a little south of 3x and Fannie is around 4x. I don’t know if theoretical marks are going to take such a dramatic hit, but if they do, bank earnings are going to take a hit next week.

The MBA sent out a statement urging FHFA to reconsider.

“The FHFA Director’s recent statements send a troubling message to borrowers, lenders, and the mortgage market. Servicers are required to offer borrowers widespread forbearance under a plan devised and approved first by FHFA and then codified by the CARES Act. Fannie Mae and Freddie Mac are contractually obligated for the payments to investors. Since Fannie Mae and Freddie Mac will eventually reimburse mortgage servicers for the payments they must advance during forbearance, Director Calabria should advocate for the creation of a liquidity facility at the Fed to ensure the stability of the housing finance market.

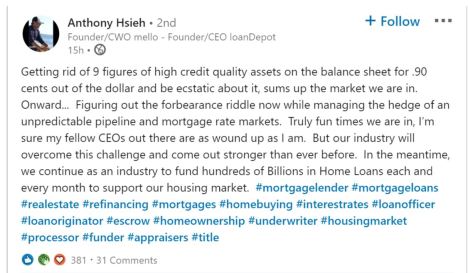

Finally, Anthony Hsieh had this to say on Linked In last night:

Filed under: Economy, Morning Report |

The inconsistency of responses by various agencies and quasi-dependencies of the federal bureaucracy was to be expected, at first, but FHFA and FDIC should be on board by now.

LikeLike

Bernie’s out

LikeLike

It’s about time.

LikeLike

Goose!

Great to see you! How’s your Coronavirus situation?

So how you feeling about Biden?

I should probably go back and read everything I’ve missed recently.

LikeLike

Good news for Sleepy Joe.

https://m.dailykos.com/stories/1935511

Bernie never has any real fight in him.

LikeLiked by 1 person

I’ve gotta say, when Larry Kudlow is giving medical advice we’re all doomed.

How the heck are you guys?

LikeLiked by 1 person

Well, Fauci is giving advice about the economy, so…..

Here, I am healthy and employed, so not doing too bad, all things considered

LikeLiked by 1 person

😎

That’s good to hear!

LikeLiked by 1 person

Busy dealing with converting the business I work for to work from home.

LikeLiked by 1 person

I still haven’t quite got it down, and I’ve been doing it for 28 days now. Good luck!

LikeLiked by 1 person

I’ve been doing it for three weeks with occasional days in the office. Finally got my home work area mostly good (I’ve got more memory for my ancient MacMini and yet another keyboard on order, as the one I just bought doesn’t feel good and space bar has issues) … and I’m as productive at home at this point as work. But it still feels weird.

LikeLike

Mich:

How the heck are you guys?

Like Brent, still getting a pay check and not sick yet, so better than many. Although being an ocean away from the entire family while air travel is quickly becoming a thing of the past is a little disconcerting.

LikeLiked by 1 person

I’m always reading about dudes who row across the Atlantic, how well conditioned are your rhomboids?

LikeLiked by 1 person

McWing:

how well conditioned are your rhomboids?

Wasting away, and they weren’t that well conditioned to start with.

LikeLiked by 1 person

Dumbest thing ever, which means it’s also the most typical thing ever from the Federal government:

To get the Paycheck Protection loans at a bank that you don’t already have an account with, you have to provide the original IRS EIN assignment letter (147c). They won’t accept a tax return as a substitute due to the recent anti-money laundering regulations..

Of course, if you opened your business years ago and didn’t save it because there was no reason to expect that the government would subsequently promulgate anti-money laundering regulations that required that exact letter to open a business bank account you are going to have to have an officer of the corporation personally call the IRS number to request a replacement one.

https://www.irs.gov/businesses/small-businesses-self-employed/lost-or-misplaced-your-ein

Except of course that they aren’t currently staffing that number due to COVID-19 changes.

LikeLiked by 1 person

catch 22.

LikeLiked by 1 person

Literally.

LikeLiked by 1 person

you would think the fact that you already have a bank account with a US commercial bank, which has a gazillion anti-money laundering P&Ps in place already would be sufficient, but I guess not

LikeLiked by 1 person

Can that be waived by the SecTres?

LikeLike

If you already have a business account it’s not a problem. It’s for setting up new accounts.

LikeLiked by 1 person

As it stands, the CARES Act is going to torpedo the servicers, which means property taxes aren’t going to get advanced to local governments. Zero thought went into this thing.

LikeLiked by 1 person

Because more lawyers are essential in a pandemic?

https://twitter.com/wesyang/status/1247669485571584000

LikeLiked by 1 person

What could possibly go wrong?

LikeLiked by 1 person

Well if they can be lawyers without a bar exam … why can’t we all be lawyers without a bar exam?

LikeLiked by 1 person

I’m pretty sure you and I are qualified.

LikeLike

Mcwing:

Because more lawyers are essential in a pandemic?

I guess they figure it is worth a shot. Harvard has done dumber things.

LikeLiked by 1 person

Harvard doesn’t have the authority to do that I presume. So they are just asking for it to publicly advocate for it?

Everyone is leveraging the COVID-19 situation for their own agendas.

LikeLike

I know I need it so that I am provided a new, 2020 Shelby Mustang GT500. It’s essential for the fight against the Wuhan flu. If I don’t get it, think Chuck Heston in The Omega Man.

LikeLike

For some reason this makes me think that he’s being attacked by Bernie Sanders and his supporters.

LikeLike

You’ve got to love Washington Post headline writers:

“Dow bounces back, climbing nearly 800 points after Bernie Sanders ends presidential bid”

https://www.washingtonpost.com/business/2020/04/08/stocks-markets-today-economy-coronavirus/

And Trump is making more sense on the next round of stimulus than the Democrats laundry list of “Don’t let a crisis go to waste” items:

“The administration’s proposal is literally a half-page of legislative text, which suggests boosting the funding for forgivable small business loans from the $349 billion that was allocated in the Cares Act, as phase three was called, up to $600 billion. That’s all.”

https://www.washingtonpost.com/opinions/2020/04/08/its-time-go-big-this-crisis-heres-how/

LikeLike

That’s a hilarious scene, “honky paradise”! Lol

LikeLike

It would be a great description on a Zillow listing.

LikeLiked by 1 person

they better include an advance facility for Fannie and Freddie servicers or the mortgage industry is going to shut down.

LikeLiked by 1 person

Anything of interest to report NoVA?

LikeLike