Vital Statistics:

| Last | Change | |

| S&P futures | 2915 | -6.25 |

| Oil (WTI) | 53.07 | 0.54 |

| 10 year government bond yield | 1.61% | |

| 30 year fixed rate mortgage | 3.84% |

Stocks are down this morning on no real news. Bonds and MBS are down as well.

Consumer inflation was flat in September, and is up 1.7% YOY. The core rate, which excludes some volatile commodities, rose 0.1% MOM and 2.4% YOY. Inflation continues to sit right in the range it has been historically.

Job openings fell from a downward-revised 7.17 million to 7.05 million, while initial jobless claims ticked up to 214k.

Mortgage Applications rose 5.2% last week as purchases fell 1% and refis rose 10%. The rate on a 30 year fixed conforming loan fell 9 basis points to 3.9%. Weaker-than-expected economic data drove the decrease.

Good news for the financial community: Trump is planning to sign a couple of executive orders, which will bring more sunlight on rulemaking, and will permit more public input in the federal guidance. Much of this guidance had been “rulemaking in secret” and this will give companies more of a head’s up when the regulatory agencies plan major changes in guidance. The CFPB sprung a nasty surprise on auto lenders during the Obama Administration, where they determined that any lenders who provide auto loans through dealerships are responsible for “discriminatory pricing.” It is this sort of the thing the order intends to limit.

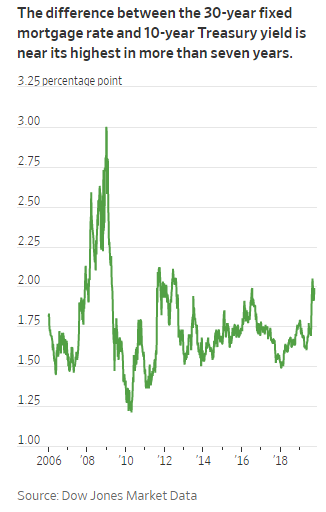

“CNBC is saying the 10 year bond yield is way lower, but I just ran a scenario and my borrower still has to pay a point and a half. What is going on?” This is a common observation these days, and it can be frustrating for both loan officers and borrowers. As the Wall Street Journal notes, that the difference between the typical mortgage rate and the 10 year bond is at a 7 year high. What is going on? First, and most important, mortgage rates are not determined by the 10 year. They are determined by mortgage backed securities, which have entirely different financial characteristics than a government bond. When rates are volatile (i.e. changing a lot in a short time period) mortgage backed security pricing will be negatively affected. In practical terms, it means that when the 10 year bond yield abruptly moves lower, it will take a few days for mortgage rates to catch up, while the time it takes to adjust to big upward moves in Treasury rates is often shorter. It also explains why it can be hard to get par pricing when you have a lot of loan level hits from Fannie (i.e. investment property, cash out refinancing, etc). The “rate stack” gets compressed and MBS investors are wary of buying high coupon securities. Bond geeks have a term for this – negative convexity – but in practical terms it means that moves in the 10 year don’t directly carry over to mortgage rates.

Filed under: Economy, Morning Report |

Someone gets it:

“Trump hasn’t gone mad. He’s gone rogue.

By Jim Hoagland

Opinions writer

Oct. 9, 2019 at 3:09 p.m. EDT”

https://www.washingtonpost.com/opinions/2019/10/09/trump-hasnt-gone-mad-hes-gone-rogue/

LikeLike

I love how the author just waves away the “promise to bring the boys back home.” as just a worthless campaign promise.

i don’t know, perhaps he meant it?

LikeLike

If Trump was a little less erratic this would work well as a reelection campaign:

“What matters to Trump is creating and burnishing his image of struggling to extract U.S. troops from the “endless wars” in which America’s foreign policy elite has plunged them. What matters to Trump is showing his supporters that he is trying to bring the boys home against the will of the deep state, which victimizes him with impeachment and victimizes them with taxes and war. The Pentagon, or the FBI, evading his orders or even fighting back against him is not a cost to be paid but a bonus to be collected for this self-described “stable genius” of branding.”

Often, he’s the worst advocate for himself.

LikeLike

Doesn’t fit in a tweet, but “we are wasting trillions in the Middle East” does.

LikeLike

There is some incredible irony in this thread.

https://m.dailykos.com/stories/1891520

LikeLike

Current betting odds:

Impeachment 71%

Conviction 23%

I think impeachment is a buy. Democrats made the decision to impeach on Inauguration Day, and this whole kerfuffle is a “show me the man and I’ll show you the crime” episode.

LikeLike

Does impeachment without conviction motivate the D base? or does they have to go into therapy for years on end and forget to vote?

LikeLike

it will motivate the D base, but i suspect they will run up the score on the west coast and NY and that will be about it.

i have no doubt that Elizabeth Warren will get 110% of the vote in Brooklyn

LikeLike

KosKidz are always saying it’s just around the corner.

https://www.dailykos.com/stories/2019/10/12/1891789/-10-SIGNS-THAT-THE-DAM-HAS-BROKEN-amp-WE-WILL-SOON-BE-RID-OF-AGOLF-TWITTLER-Saturday-s-Good-News?utm_campaign=trending

LikeLike

Watching the hysteria over withdrawing some troops from Syria (where they were never authorized to be in the first place) makes me wonder how bad the melt down will be when/if the US withdraws from Afghanistan.

LikeLike

and if Elizabeth Warren does it, the roles will be reversed.

LikeLike

Worth noting:

“Top EU officials in Turkey to save refugee pact

…

Under a 2016 EU-Turkey agreement, Turkey committed to preventing migrants from reaching Greece. Greece was also permitted to send rejected asylum-seekers back to Turkey. In return, Turkey was pledged €6 billion ($6.6 billion) to house refugees in camps, while the EU also accepted a certain contingent whose asylum claims had been recognized. So far €5.8 billion has been allocated and €2.6 billion disbursed.

But Erdogan has complained that his country has so far received too little of the €6 billion promised by the EU for the years 2016 to 2019, while shouldering costs of more than €36.5 billion at a time the Turkish economy is struggling. ”

https://www.dw.com/en/top-eu-officials-in-turkey-to-save-refugee-pact/a-50687533

LikeLike

Doesn’t that mean Turkey can constantly threaten to flood the EU with migrants if they don’t get money? That sounds like a set up for interminable extortion.

LikeLike

Yep, but it’s also come to a head with the Turkish economy doing worse. Hence the invasion into Syria to pave the way to move them back into Syria, at the expense of the Kurds.

LikeLike

KosKidz all in for American soldiers getting killed.

https://www.dailykos.com/stories/2019/10/13/1892187/-Trump-cuts-and-runs-ordering-full-retreat-of-U-S-forces-in-Syria

LikeLike

I had a very liberal friend in college (who is still very liberal) who never the less was principled enough to get pissed at the end of the gulf war and all the folks who had been protesting and staging “die ins” were sitting around moping And all glum that it was over and that they hadn’t really made it happen. They were seeing the Gulf War as their Viet Nam and just as it was starting, it was over. My friend was like: “people will stop dying! The war is over! Be happy!”

That apparently is not a thing liberals do now.

LikeLike

I’m still not bothered by this:

“Russia patrolling between Turkish and Syrian forces after U.S. troops withdraw”

https://www.washingtonpost.com/world/middle_east/syria-says-government-soldiers-enter-manbij-after-us-troops-withdraw/2019/10/15/d494405a-eeb8-11e9-bb7e-d2026ee0c199_story.html

LikeLike

And this should be interesting:

“The Best Campaign Money Can Buy

Tom Steyer, the outsider billionaire candidate, will make his debate-stage debut tonight.”

https://www.theatlantic.com/politics/archive/2019/10/tom-steyer-2020-debate-impeachment/600019/

LikeLike

Latest Taibbi on the intelligence agencies, the media, and Trump

https://taibbi.substack.com/p/were-in-a-permanent-coup?fbclid=IwAR30lx8ZPACrJTINwxzJr1LHRIfXJwmqgHeZ_D9jFl9cn3VNyTt8Z7MGAqo

LikeLike

From Taibbi:

My discomfort in the last few years, first with Russiagate and now with Ukrainegate and impeachment, stems from the belief that the people pushing hardest for Trump’s early removal are more dangerous than Trump.

Taibbi and I are in rare agreement.

That is the best column of his that I’ve read.

LikeLike

You should read the whole series under “Untitledgate”.

LikeLike

Are all of these written by Taibbi?

I just looked at a couple. Very interesting, and not in the typical Taibbi style that I am used to.

LikeLike

Yes, they all are. Hate, Inc. is my favorite series so far.

This is his personal writing outlet, not going through Rolling Stone.

LikeLike