Vital Statistics:

| Last | Change | |

| S&P futures | 2653.73 | -17.75 |

| Eurostoxx index | 355.2 | -1.16 |

| Oil (WTI) | 52.83 | -0.97 |

| 10 year government bond yield | 2.76% | |

| 30 year fixed rate mortgage | 4.48% |

Stocks are down this morning on overseas weakness. Bonds and MBS are up.

Today begins the World Economic Forum in Davos. For the most part, it is basically an event where CNBC interviews hedge fund managers and government officials in the snow, however there is always the chance that someone could say something market moving.

Dave Stevens (formerly head of the MBA) outlines some of the effects of the shutdown on the mortgage business. For most lenders, the shutdown is a non-issue. 4506-Ts, social security, and flood insurance is not impacted. Lenders located in areas where there are a high quantity of government workers are unable to get VOEs for furloughed workers. This is beginning to impact closings – while the GSEs will permit loans to close without a VVOE from the government, these loans are ineligible for sale until this is done. While this won’t impact lenders with a balance sheet (i.e. banks), most independent mortgage originators won’t be able to hold a funded loan and wait out the shutdown.

Industrial Production rose 0.3% in December, while manufacturing production rose 1.1%. Capacity Utilization ticked up to 78.7%. Motor vehicles and construction products drove the increase.

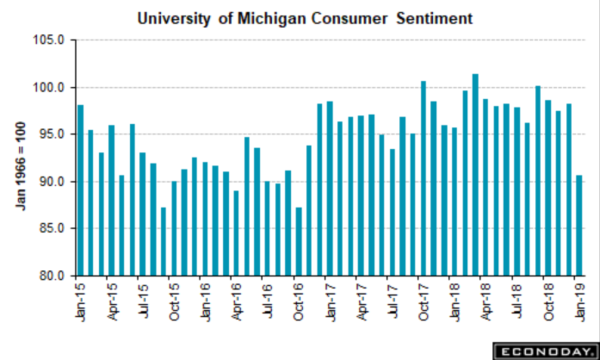

Consumer sentiment plunged in early January according to the University of Michigan consumer sentiment survey. Whether this is shutdown driven or not is anyone’s guess, but it does add fuel to the argument that the Fed went too far in 2018. The big change – future expectations.

China’s growth has slowed to the lowest levels in almost 3 decades – falling to 6.4% in the fourth quarter. The government does have some levers to push, however the bigger concern is their real estate bubble, which is vulnerable. Consumer spending is also decelerating as well, albeit from a torrid pace. The biggest effect on the US would be to hold a lid on interest rate increases and to slow down global growth. The effect of a Chinese recession will probably have the same sort of effect that Japan had in 1990 – depressing global growth, lowering import prices and allowing countries to grow without goods and services inflation.

The FHFA is not going to defend the constitutionality of its structure. The Fifth Circuit ruled in July that the FHFA is unconstitutional in that it has too much power and violates the separation of powers. The previous head of FHFA – Mel Watt – planned to appeal the decision, however the Trump Administration agrees with the ruling and will not contest it. The decision from the Fifth also ruled that the government’s current net worth sweep (in other words, all profits from the GSEs go straight to Treasury) is Constitutional. So, basically the net effect would maintain the current structure, but also allow the President to fire the head of the FHFA at will.

Note that Mark Calabria (the Trump nominee to run FHFA) is not a huge fan of securitization in general and all of the general subsidies the government puts in the US residential real estate market.

Filed under: Economy, Morning Report |

“The decision from the Fifth also ruled that the government’s current net worth sweep (in other words, all profits from the GSEs go straight to Treasury) is Constitutional. ”

But they are still allowed to be counted as “off book” for accounting purposes as “independent” entities?

LikeLike

the government owns 79.9%, which is below the 80% threshold where the debt shows up on the government’s balance sheet.

incidentally, this was the reason LBJ “privatized” the GSEs in the 1960s.

LikeLiked by 1 person

Yes, but the whole fight is over the fact that the remaining 20.1% get nothing even though the original bailout has been repaid.

So basically the court is still allowing the government to have it both ways.

LikeLike

Given Fannie Mae’s footprint in the mortgage market, it was impossible for them to go through a normal bankruptcy – it would have shut down 80% of the mortgage market.

They basically went though a bankruptcy without calling it that. In a normal BK, the common and prefs would have been wiped out.

LikeLike

So be it, but they shouldn’t be able to continue to pretend it’s off book.

LikeLiked by 1 person

Orwellian quote of the day:

“Restoring nonphysical violence to the definition of domestic violence is critical.”

https://slate.com/news-and-politics/2019/01/trump-domestic-violence-definition-change.html

LikeLike

it’s really simple. if he was an asshole when you were dating, he’s going to be an asshole if you marry him.

“Many survivors—particularly those from minority or marginalized communities—are reluctant to report domestic violence to law enforcement. Race, class, sexual orientation, and immigration status can significantly affect whether a survivor decides to seek outside intervention when suffering violence in the home.”

does anyone have agecny anymore? anyone?

LikeLike

you do. you are responsible for everything that is wrong and unfair in the world.

LikeLike

sorry.

LikeLike

It’s all well and good if they don’t want to report it for personal reasons, but at that point it ceases to be a problem that the Justice Department can address.

This would be the root disconnect:

“This makes no sense for an office charged with funding and implementing solutions to the problem of domestic violence rather than merely prosecuting individual abusers.”

DoJ isn’t HHS or social services.

LikeLiked by 1 person

does anyone have agecny anymore? anyone?

Millennials don’t understand the concept. And the de-masculinization of the culture does not help.

LikeLike

over one-third of U.S. women (43.5 million) have experienced “psychological aggression” at the hands of an intimate partner.

Psychological aggression is the modus operandi of women in relationships. It’s how they fight, show aggression, and compete.

I realize this was exclusively about women, but I’m guessing there’s a glaring double standard when it comes to the assessing of nonviolent violence of the order of “when women do it it’s fine”. But maybe not.

LikeLike

Damn, I may actually have to watch this (usual) snoozefest.

https://hotair.com/archives/2019/01/22/report-trump-intends-deliver-sotu-scheduled-capitol-despite-pelosis-objection/

LikeLike

This is peak 2019.

https://www.cnn.com/2019/01/21/tech/twitter-suspends-account-native-american-maga-teens/index.html

LikeLiked by 1 person

The Smirk That Triggered a Million SJWs.

LikeLike

My take on it is everyone was looking to be a confrontational asshole there. The Black Israelites, the drum banging native activists and the kids doing the cheers and tomahawk chops.

You don’t go to a protest to engage in a thoughtful debate with your opponents. You go to get in their face and provoke them.

It’s absurd how often the “diffuse the situation” assertion by Phillips is let slide by the media. He wasn’t diffusing the situation, he was getting in their face with his drum.

Which is fine as protest, but don’t pretend it’s something else.

LikeLiked by 1 person

the media is just doing its part as a cog in the resistance.

probably distracts from the blue-on-blue warfare that depressed turnout for the women’s march.

LikeLiked by 1 person

Some people actually admit it:

https://www.realclearpolitics.com/video/2019/01/22/behar_covington_catholic_incident_happened_because_were_desperate_to_get_trump_out_of_office.html

LikeLiked by 1 person

Bitch is wack.

LikeLike

jnc:

This is peak 2019.

I just love how CNN claims “…it was @2020fight’s caption that helped frame the news cycle.” Right…the NYT and the WaPo and CNN itself – the actual arbiters of the “new” – aren’t responsible for the way they framed their own stories at all. It was all because of a tweet. The shamelessness of the media knows no bounds.

LikeLiked by 1 person

If only it had been Russia instead of Brazil. Now that would have been peak 2019.

LikeLiked by 1 person

Still feels pretty 2016.

LikeLike

I do give the post credit for this:

https://www.washingtonpost.com/opinions/2019/01/23/fuller-picture-how-major-media-outlets-handled-their-evolving-accounts-covington-story/

LikeLike