Vital Statistics:

| Last | Change | |

| S&P futures | 2919.25 | -12.25 |

| Eurostoxx index | 381.23 | -2.61 |

| Oil (WTI) | 76.03 | -0.38 |

| 10 year government bond yield | 3.20% | |

| 30 year fixed rate mortgage | 4.87% |

Stocks are lower this morning in the face of a global government bond rout. Bonds and MBS are down.

Global bond yields are sharply higher this morning. There doesn’t appear to be any particular catalyst, but it is affecting Japanese and German bonds as well as the US. The 10 year yields 3.2% this morning after starting yesterday at 3.08%. Interestingly, the Fed Funds futures haven’t changed at all, so this doesn’t seem to be driven by a re-assessment of Fed policy. If you look at the TIPS market (Treasuries that forecast the change in CPI), there is no change in the market’s assessment of inflation. So this has been largely confined to the long end. The short Treasury trade is one of the biggest trades on the Street, and maybe some big funds put more money to work shorting / underweighting global bonds going into the 4th quarter. 2s-10s are trading at 31 bps.

Jerome Powell was interviewed on CNBC yesterday, and signaled that more hikes are on the horizon. “Interest rates are still acommodative, but we’re gradually moving to a place where they will be neutral,” he added. “We may go past neutral, but we’re a long way from neutral at this point, probably.” Interesting to see him characterizing current policy as “accomodative” when the word was taken out of the September FOMC statement. The “may go past neutral” comment has been cited by some in the press as the catalyst for yesterday sell-off, but the Fed Funds futures don’t reflect that.

Job cuts rose to 55,000 in September, according to outplacement firm Challenger, Gray and Christmas. This was driven primarily by announced layoffs at Wells Fargo. “As the job market remains near full employment and companies struggle to find workers, large-scale job cut announcements like the one from Wells Fargo will actually provide the workers necessary for companies to gain momentum and sustain growth,” said John Challenger, Chief Executive Officer of Challenger, Gray & Christmas, Inc.

Hurricane Florence appears to have had little impact on initial Jobless Claims which fell to 207,000 last week. As companies ramp up for the fourth quarter, qualified workers are hard to find. That might have been part of the reason for Amazon’s announcement on wages – they have to compete with everyone else for seasonal workers. Note that Fed-Ex is paying pilots bonuses of $40-$110k to keep them from retiring.

Lennar reported 3rd quarter earnings yesterday, which were decent, but forward guidance (partially driven by Hurricane Florence) was disappointing, and the stock sold off 2%. Orders increased, but its Q4 forecast was below estimates. The whole sector was hit yesterday as well, as a combination of higher mortgage rates and input costs are creating affordability problems. Most of the metrics were hard to compare YOY because of the CalAtlantic transaction.

Factory orders increased 2.3% in August driven by transportation orders. This is the fastest pace since September last year.

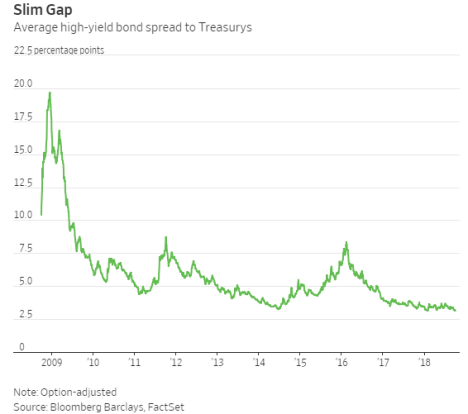

Investors are bailing on high-yield debt, as spreads to Treasuries are at post-crisis lows and rates are going up. With bond-like upside and stock-like downside, the risk-reward for the asset class is deteriorating. IMO, some of the action we are seeing in the stock and bond markets may simply be a re-emergence of money market investment vehicles which paid so little during the ZIRP years that investors didn’t bother with them. With short term rates pushing 3%, the asset class is making sense again.

Of course the other asset class that has been moribund since the crisis has been the private label MBS market. While there are governance issues left be sorted out, higher absolute rates will go a long way towards bringing back that sector (and the type of lending that accompanies it). Mortgage REITs who have feasted on MBS thrown overboard in 2009 and 2010 will have to replace that paper with new issuance.

Filed under: Economy, Morning Report |

Presumably you avoid this by incorporating in Delaware.

https://www.washingtonpost.com/opinions/california-is-forcing-the-issue-of-diversity-in-corporate-america–finally/2018/10/04/56991cd0-c753-11e8-b2b5-79270f9cce17_story.html

LikeLiked by 1 person

Which is why E. Warren wants a Federal Charter so much.

LikeLike

You’d think, her being an injun and all, she’d be mighty suspicious of any agreement involving the Federal government.

LikeLike

The playbook

LikeLike

All I used to hear from lefties about the FBI was COINTELPRO. Now it’s their sainted Federal agency.

https://m.dailykos.com/stories/1801434

LikeLiked by 1 person

This could be major:

https://www.bloomberg.com/news/features/2018-10-04/the-big-hack-how-china-used-a-tiny-chip-to-infiltrate-america-s-top-companies

LikeLiked by 1 person

Now that’s some quality hacking!

LikeLike

Former Mexican ambassador to China weighs in.

LikeLike

China is not having a good year.

LikeLike

COUNTERNARRATIVE ALERT!!

COUNTERNARRATIVE ALERT!!

LikeLike

“eyewitness misidentification” aka blaming the victim.

LikeLike

There have been a number of studies (psychology and social studies are easily done but often difficult to replicate, so take with a grain of salt) that indicate eyewitnesses are pretty much worthless most of the time. Scott Adam relates a tale of being robbed at the bank where he described the person who was, hours before, holding a gun on him, and got the description entirely wrong, and was mystified when he saw the video tape of the interaction.

Eyewitnesses are worthless, for the most part. Unfortunately. But being an incredibly good and accurate eyewitness is apparently not an evolutionary survival trait.

LikeLike

This is how you troll:

https://www.motherjones.com/kevin-drum/2018/10/cultural-studies-is-the-target-of-another-hoax-and-this-one-stings/

LikeLike

I told George I might have a moment today and I haven’t read your comments in a week so I am going to write what I wrote George when he kindly asked after me. While I understood Kavanaugh’s anger I would never want to again appear before a judge who could sustain hostility as long as he did. Volokh’s guys are of two minds about it and this is a reply to Eugene Volokh who wants Kavanaugh confirmed.

http://reason.com/volokh/2018/10/04/a-short-response-to-eugenes-judicial-tem

Kavanaugh is by his record on the bench fully qualified. He has never acted like that on the bench. So maybe he never would. But this was the promotion interview, and that says something too. In any case, it gives me pause now.

LikeLike

I thought he was remarkably restrained. I’d argue that since he didn’t punch any of the Democratic Senators, particularly Feinstein and Booker, it made him look rather Dukakis-like and perhaps was disqualifying. Not slugging someone accusing you of gang-rape, kidnapping and drugging victims as well as calling you evil seems rather lifeless to me. Seriously.

LikeLike

I suspect it was strategic for the environment. A decision was made that clear offense would be better than trying to seem humble and calm in the face of such outrageous accusations and such . . . well, questionable tactics. Frankly, I don’t know that there is a good answer there. Anything he did would have been seen as proof of guilt by the folks accusing him. Which is what happens when you admit largely evidence-free accusations and essentially “spectral” evidence, hearsay, and guilt-by-association into the proceedings. IMO.

LikeLike

Mark:

I would never want to again appear before a judge who could sustain hostility as long as he did.

Why do you think his demeanor as an accused criminal has any relevance to his being a judge?

But this was the promotion interview…

Huh? How many “promotion interviews” involve half the promotion committee trying to accuse you of sex crimes as a 17 yr old? I don’t understand how anyone can view the Ford hearings as anything other than a transparently political show trial.

LikeLike

Why do you think his demeanor as an accused criminal has any relevance to his being a judge?

I think it might, in another context. In the context of needing to approach hostile interrogators potentially using slander, innuendo, and manipulation to defeat your nomination, he had to approach with tactics and strategy, some of which may have been coached (in a short time period), or some of which might have been his own strategizing.

In the context, I have a hard time finding either his demeanor or the questions and answers particularly indicative of his judicial temperament or appropriateness to the position. If I were making a decision to vote yay or nay, I’d ignore all of that and just read his opinions. Review cases.

LikeLike

Senator Menendez is their Appeal to Authority!

https://m.dailykos.com/stories/1801552

Dude was “credibly accused” of pedophilia for fucks sake.

LikeLike

The words “credibly accused” need to be considered to be a sign that “it’s almost certainly bullshit, and we definitely know it’s almost certainly bullshit, but we don’t want it to be so we’re trying to give things without credibility some semblance of credibility by putting the word “credible” where ever we can fit it.

LikeLike

Emanations from penumbras perchance?

LikeLike

Sidney Blumenthal II

https://www.foxnews.com/politics/accused-doxxer-of-gop-senators-allegedly-threatened-to-publish-lawmakers-childrens-health-info

LikeLiked by 1 person

Bah! That’s not news! The only news is that the FBI didn’t get to do an endless, open FBI investigation into Kavanaugh’s behavior 30 years ago.

LikeLike