Vital Statistics:

| Last | Change | |||

| S&P futures | 2670 | 6.9 | ||

| Eurostoxx index | 388.46 | 1.44 | ||

| Oil (WTI) | 70.62 | 0.89 | ||

| 10 Year Government Bond Yield | 2.94% | |||

| 30 Year fixed rate mortgage | 4.54% | |||

Stocks are higher this morning as oil tops $70 a barrel. Bonds and MBS are flat.

Jobs report data dump:

- Nonfarm payrolls 164,000 (lower than estimates)

- Unemployment rate 3.9%

- Average hourly earnings +.1% MOM / 2.6% YOY

- Labor force participation rate 62.8%

This was the second month in a row where the labor force participation rate fell. The labor force fell by 236k, while the population increased by 175k. Wage inflation remains present, however it is still unlikely to drive higher inflation in the overall economy. The unemployment rate fell to the lowest since early 2000. This report takes some pressure off the bond market, and makes another run at 3% for the 10 year less likely.

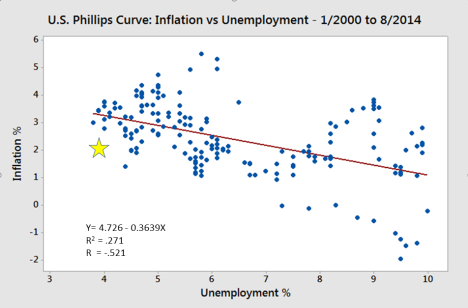

The drop in the unemployment rate along with moderate wage growth is somewhat of a Goldilocks moment for the Fed. The Philps Curve is an older economic model which suggests that inflation should rise as unemployment falls, which makes sense: Unemployment falls -> workers become scarce -> wages rise -> those costs get passed on to consumers. In reality, the relationship between unemployment and inflation has been weak (R^2 = .27). The low r-squared gives away the weakness of the model – it is too simplistic, plus the unemployment rate might not be the best measure of employment strength since it ignores the long term unemployed. However, if you look at the plot below, you can see we are at a very “Goldilocks” point, which is denoted by the yellow star.

The upcoming week will have the consumer price index and the producer price index, but that should be the only market-moving data. We will have some Fed-speak as well today and Wednesday.

Donald Trump has until May 12 to renew the Iran deal. Israel calls the deal fatally flawed, while Iran says the US will regret not renewing it. West Texas Intermediate is trading over $70 on fears the deal will not be renewed.

Doctors tend to have difficulties getting a mortgage early in their careers – they usually have a high level of student loan debt, no savings and the earnings early on can be low. Mortgages that carry a higher interest rate but don’t require downpayments are becoming more popular for this market. These loans can carry an interest rate 25 -100 basis points over prevailing rates. although they usually don’t require PMI. One catch – the prepay speeds on these mortgage will almost certainly be high.

The CFPB dodged a bullet – PHH will not appeal the DC Circuit’s ruling that rejected their claim that the single-director structure is unconstitutional. There are other cases in the process that also use that claim, so it is possible the question may come to SCOTUS. If one of these cases makes it to SCOTUS, the only one with standing to defend the agency is the Administration, who probably won’t defend it.

Merger news: Mutual of Omaha is buying Synergy One. Synergy One will be a wholly-owned subsidiary and will continue to operate out of San Diego.

Filed under: Economy, Morning Report |

This is a devastating piece about Mueller and Flynn.

https://www.nationalreview.com/2018/05/russia-report-redactions-cover-fbi-missteps/

It’s long but well worth your time.

LikeLike

Snopes fact checked this article..

LikeLike

How is this not the parent’s fault?

https://www.dailykos.com/stories/2018/5/7/1762616/-Trump-is-waging-a-quiet-war-on-migrant-children-and-their-parents-at-the-border

LikeLike

“Brown” people have no agency. Nothing that ever happens to them is their own doing.

LikeLike

Dayum!

https://www.newyorker.com/news/news-desk/four-women-accuse-new-yorks-attorney-general-of-physical-abuse

LikeLike

how long did the media know about it and kept it quiet?

Or to put it another way… the media has an army of journalists trying to figure out if Trump cheated at golf. Trump was tweeting about Schneiderman having issues in 2013. If he knew about it…

Zero interest on the part of the media to even investigate. Speaks volumes about media bias…

Circle the wagons and protect the Party…

LikeLike

Jesus, this broad’s friends are pieces of work.

https://pjmedia.com/instapundit/296198/

LikeLike

Just an FYI to my friends at ATiM….It appears that I will be relocating to London some time in the fall. My company has asked me to head up the London trading desk, and given that starting in September we will officially be empty-nesters, it seems like a feasible idea, so I took the offer. I won’t be going over for good until (probably) October, with Mrs ScottC to follow sometime after Christmas. In this wondrous age of technology, this will have no impact on my (admittedly sparse) participation here at ATiM, but I thought you all might be interested nonetheless. If you find yourself over in London, please do let me know and I will take you to the nearest pub.

I will wait to see whether I have the time and inclination, but it is possible that I might re-boot my old blog The American Expatriate once I am back over there. If I do, will let you all know, and could even conceivably cross-post to here anything that I do there. But that is for future consideration. Just wanted to give anyone who was interested a heads-up about what’s going on with me.

LikeLike

Wow, congratulations! I guess Brexit isn’t destroying banking in London! You’ve lived there before, what’s the best thing about living in London?

LikeLike

McWing:

Thanks. The best thing about living in London? It’s not in Europe!

Pub lunch on a Sunday afternoon, Premier League soccer, and the history. I love going to historical sites and museums in the UK. To be honest, it’s the job that is the primary attraction. If it wasn’t for the professional opportunity, I wouldn’t do it. I far prefer American life, and I will especially miss college football Saturdays, but we have friends over there, so it should be easy to fit back in socially, and since it will be just my wife and I, it will be easy to travel, including back to the US for the occasional tailgate. So should be a good experience for a few years. Plus it is prompting me to get out of Connecticut, which while costly, will be good in the long run I think.

LikeLike

Any kind of relocation bonus to help off set the loss you are taking with selling the house that you mentioned previously?

LikeLike

No, not really. The old expat packages with all kinds of perks that used to exist aren’t really being done anymore, especially in firms like mine. And to be honest I can’t really blame them. Why should they get me out from under my own bad housing decision made 12 years ago? But there is pretty good upside potential on the overall compensation package, better than I have in NY right now, so that should help me claw something back if things work out. Here’s to hoping!

LikeLike

Congrats Scott!

LikeLike

Thanks! I’ll have more opportunities to rant about the UK media now.

LikeLike

Congrats! Are you going to be in the City or the Docklands?

LikeLike

Thanks. We are in the City, near St. Paul’s.

LikeLike