Vital Statistics:

| Last | Change | |||

| S&P futures | 2660 | 13.5 | ||

| Eurostoxx index | 373.93 | 6.6 | ||

| Oil (WTI) | 63.22 | -0.16 | ||

| 10 Year Government Bond Yield | 2.81% | |||

| 30 Year fixed rate mortgage | 4.41% | |||

Stocks are higher this morning on no real news. Bonds and MBS are down.

Initial Jobless Claims increased to 242k last week. Job cuts also jumped to 60k from 30k according to outplacement firm Challenger, Gray and Christmas. Retailers (probably Toys R Us) drove the increase. This is the biggest jump in 2 years.

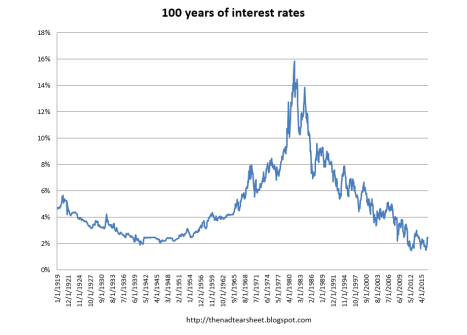

JP Morgan CEO Jamie Dimon discusses the state of the economy in his annual letter to shareholders. He argues with normal growth and inflation around 2% (the current state of affairs) historically, we would expect to see short-term rates around 2.5% and the 10 year trading around 4%. He argues that QE (both here and abroad) is what is suppressing the 10 year yield. That will reverse for the Fed this year, and in the near future overseas. There will be some countervailing forces at work, but we are in such uncharted territory that no one knows how it will turn out. Dimon then starts discussing the surprise 1979 rate hike (100 basis points on a Saturday!) and talks about how the Fed Funds rate then opened 200 bps higher that Monday. Just for the record, I want to put this chart out there – interest rate cycles are long. We are probably a generation (or two) from that sort of situation again, at least if historical observations are any guide.

Dimon makes another point in his letter about the state of the financial system. On one hand, it is much more stable and well-capitalized. Money market funds have higher restrictions, and there is much less leverage in the system overall. That said, post-crisis policy has removed the counter-cyclical levers in the financial system. First of all, the Volcker rule has meant less market-making. Investors have noted that it is much harder to trade securities, especially the less liquid ones. In a downturn, expect to see many securities go no-bid. In other words, investors will be stuck riding something down. Second, the newer bright lines means that banks will not be able to use their reserves to step in and lend. In Reminiscences of a Stock Operator, there was a credit crunch and banks were fully lent out to the reserve point. J.P. Morgan exhorts the banks to use their reserves. That is what they are for! And finally, in a swipe at the Obama Administration, the big banks are not going to agree to buy out the failing ones. JP Morgan bought Bear at the height of the crisis, as a favor to the Bush Administration. The Obama Admin then slammed them with fines for all of Bear’s sins.

We aren’t going to see much in the way of inflation without wage growth, and at least one economist (Noah Smith) is arguing that we aren’t seeing any because employers have too much market power. He also argues that minimum wage laws are not job killers, at least in the aggregate, despite what Econ 101 would say. His argument is that if employers do have market power, then they are earning a higher return than they would otherwise accept on their workforce. In other words, you could force them to hike wages, and they still will make enough that it won’t make sense to fire people. He then cites the usual Rx for increasing wages: higher minimum wage laws and more unions. The question is then where employers have market power. Perhaps in one-company towns that could be the case. But en masse? Possible, but not probable.

The trade deficit increased again in February, giving ammo to those who agitate for a trade war. A trade war could have an effect on interest rates. Right now, China sends us ships of stuff (phones, plastic goods, all sorts of things). In return (they aren’t giving it away), they have to take something. Right now, they largely take things like agricultural products. We would prefer it if they bought even more stuff. Since they aren’t, the get US dollars instead, which they then invest in Treasuries and other US assets. If trade decreases with China, they will theoretically buy less Treasuries, and that would mean higher interest rates, at least at the margin. To put this in perspective, the trade deficit with China in February was $29 billion. During QE, the Fed was buying $45 billion in Treasuries and MBS a month. So that isn’t chump change.

It is important to understand that we are in a negotiation phase with China, that many of these things are just proposals. Historically, these things get solved by a meaningless pledge that allows the US to claim victory, but doesn’t really make that much of a difference. As China gets richer, it will undoubtedly purchase more US goods and services. However, the savings rate is sky-high there – which means that consumption is low. They are in building mode.

Ginnie Mae has noted the abuses in VA IRRRLs and is taking action against some lenders. New Day and Nations Lending are no longer eligible to issue securities into multi-issuer pools. They will only be able to issue spec pools, which will trade at a discount.

Filed under: Economy, Morning Report |

It’s jesus freaks all the way down.

https://www.salon.com/2018/04/05/have-christian-nationalists-staged-a-soft-coup-with-trump-as-their-figurehead/

LikeLiked by 1 person

This seemed the most likely outcome.

Did KW not see it or was his intent to get fired?

https://www.thewrap.com/conservative-commentator-kevin-williamson-fired-atlantic-abortion-podcast-surfaces/

LikeLike

The mob rules…

LikeLike

The funny thing is that lefties routinely assert that, in order to be principled and consistent, the pro-life position must advocate for treating a woman who gets an abortion as a murderer. When KW does exactly that, he gets reviled and excommunicated for being beyond the pale.

LikeLiked by 1 person

The Atlantic comes off as either stupid or cowardly in this whole affair (my take is the latter).

Apparently the difference between past indiscretion and fire-able office is choice of medium, tweet vs podcast.

Good take:

https://reason.com/blog/2018/04/05/kevin-williamson-fired

LikeLiked by 1 person

Not surprised.

LikeLike

Who on twitter here and how do I follow you?

LikeLike

My Twitter info is @gbowden41. Just search for it on twitter and then click on my avatar (it’s an American flag above a Texas flag) and then click “follow”.

LikeLike

@brentnyitray I love Twitter. Really

yello is on too.

LikeLike

I just followed you.

LikeLike

One person’s terrorist is another person’s freedom fighter.

And a woman dedicated to creating private schools in charge of public education. As well as a guy dedicated to deregulation and who thinks climate change is a hoax in charge of the EPA.

If you have money, a sociopathic worldview and are willing to kiss His Orangeness’ ass, you get hired to dismantle some Department.

Please log in or sign up to continue.

Gwennedd April 04 · 06:49:17 PM

https://m.dailykos.com/stories/1754477

LikeLiked by 1 person

Axios admits it has shitty sources.

Trump’s closest confidants speak with an unusual level of concern, even alarm, and admit to being confused about what the president will do next — and why.

https://www.axios.com/newsletters/axios-am-3bcc89b8-e634-43d0-b337-98572e852c4a.html?chunk=0&utm_term=twsocialshare#story0

LikeLiked by 1 person

Shitty sources, my foot. They are just making shit up.

LikeLike

This has been making the rounds on the left.

https://m.huffpost.com/us/entry/us_5ac29ebae4b04646b6454dc2

Did anybody here doubt that he did it cause he’s a muzzie true believer and ISIS fanboy?

LikeLike

Ok, I just nutted.

Acting Consumer Financial Protection Bureau director Mick Mulvaney has told Sen. Elizabeth Warren, D-Mass., that he doesn’t plan on responding to her questions about the agency, and said it’s her fault that he is not required to answer.

Big Squaw threaten heap big trouble.

https://www.washingtonexaminer.com/policy/economy/mick-mulvaney-elizabeth-warren-cfpb-accountability

No refractory period for me!

Mulvaney, a conservative who was an outspoken critic of the bureau during his time as a congressman, told Warren in a letter sent Wednesday that the structure of the agency, which she helped design, shields him from accountability.

Not gonna lie, I’d hit him.

LikeLiked by 1 person

That’s fantastic. Genuinely awesome.

LikeLike

Trump proposes more tariffs, sending the SPUs down 36 handles…

LikeLike

For those that consider Trump a “dictator”

On this day in history, FDR issues Executive Order 6102, which prevents the “hoarding” of gold, and allows the government to simply take it.

LikeLike

Serious question, am I supposed to be shocked that so-called innocents die in war? If waiting to strike possibly saves 1 million lives but puts at risk one American to suffer even a hangnail, tough. Don’t wage war against the US. It’s pretty obvious that sparing innocents almost always prolongs the conflict and generates more death. You need to make it impossible for the enemy to continue,

Doing so risks the existence of all they hold dear and continuing means complete annihilation.

LikeLike

You sound like you have been reading up on General Sherman.

LikeLike

Total war, yo.

Would the Japs have surrendered w/out Hiroshima and Nagasaki? That’s the extreme case example. The nihilism of the Japanese versus the muzzies is very similar here.

LikeLike

Hiroshima would have been enough but that conclusion required hindsight. Correct decision when made.

LikeLike