Vital Statistics:

| Last | Change | |

| S&P Futures | 2351.5 | -11.0 |

| Eurostoxx Index | 368.0 | -4.9 |

| Oil (WTI) | 53.8 | -0.7 |

| US dollar index | 90.7 | |

| 10 Year Govt Bond Yield | 2.33% | |

| Current Coupon Fannie Mae TBA | 102.045 | |

| Current Coupon Ginnie Mae TBA | 103.17 | |

| 30 Year Fixed Rate Mortgage | 4.12 |

Stocks are down this morning on disappointing earnings and slumping commodity prices. Bonds and MBS are up.

Consumer sentiment flattened out in February, according to the University of Michigan consumer sentiment survey.

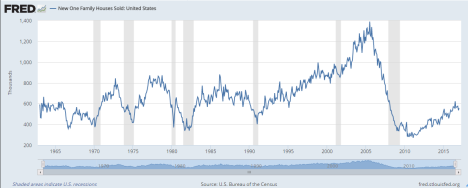

New home sales rose 5.5% YOY to 555,000 in January. This is 3.7% above the revised December reading. The median new home price was $312,900 and the average price was $360,900. At the end of the month, there were 265,000 new homes for sale, which represents a 5.7 month supply. You can see from the chart we are barely back to pre-1990 levels which doesn’t even take into account things like population growth and obsolescence.

Donald Trump is scheduled to speak at CPAC this morning. Shouldn’t be market-moving, but just be aware.

Bonds have been rallying a touch on a report that Donald Trump’s infrastructure plan will be moved out to 2018. The thinking is that Democrats are united in opposition at the moment (there is a lot of handwringing over handshaking), but by 2018, midterm elections will be looming and Trump could pick off some Democratic Senators up for re-election in states Trump won like Jon Tester or Claire McCaskill. Given that the Fed’s forecast of 2-3 rate hikes in 2017 was contingent on fiscal stimulus, this could ultimately push the Fed to hike only twice this year.

Morgan Stanley is out with a call saying the housing recovery is still in the “middle innings.” That is probably a fair assessment, however the building boom required to balance out supply and demand has yet to happen. As we know, the market for starter homes is extremely tight as builders focused on the luxury end of the market post-crisis and professional investors bought up small houses to turn into rentals.

Did you know that if you wanted to lend money to the German Government for two years, it would cost you almost a percent per year? In other words, you would have to pay 101.73 to get back 100 in two years. Demand for safe collateral in Europe as well as fears of the French election have pushed German 2 year yields to -95 basis points. Strange times we live in.

We are starting to see selling pressure at the ultra-high end of the real estate market as the new Chinese capital controls take effect. In an attempt to control currency outflows, the Chinese government imposed controls which limit real estate investments overseas. The most vulnerable cities are on the West Coast, particularly Seattle and San Francisco, although it should hit all of the big urban areas. Big McMansions which used to be snapped up in days now sit vacant in LA.

Filed under: Economy, Morning Report |

Quote of the Day:

“Life isn’t fair. It’s not our duty to try to make it so.”

NoVAHockey – 2/14/2017

LikeLiked by 2 people

what a racist!

LikeLike

More cis-normative, not-intersectional if anything.

Definetly not #woke.

LikeLiked by 2 people

here, you are all equally worthless

LikeLiked by 1 person

Let me see your triggered face!

You don’t convince me!

LikeLiked by 1 person

The GOP is idiotic to try and stand in the way of MJ legalization.

http://reason.com/blog/2017/02/24/most-republicans-oppose-federal-interfer

This is their one chance to bring libertarian-leaning moderates who are sick of progressive overreach into the tent and they are blowing it.

LikeLiked by 1 person

Of course they are. This is who Sessions and a lot of the Republicans are. There’s a reason Ron & Rand Paul are marginal players in the Republican caucus.

LikeLike

Yup.

LikeLike

I’m starting to believe Trump could get himself impeached.

http://www.esquire.com/news-politics/politics/news/a53406/reince-priebus-fbi/

LikeLike

Might be a big nothingburger.

http://hotair.com/archives/2017/02/24/trump-rips-fbi-for-not-stopping-leakers-after-cnn-accuses-priebus-of-contacting-bureau-about-russia-story/

LikeLike

Trump should just declassify all of it and release it.

LikeLike

Dude!

That’s fucked up.

LikeLike

which is probably a risk with DJT too

LikeLike

For all the liberals getting the vapors of DJT banning CNN, NYT and Politico from a press conference, memories are short

LikeLike

Jesus, but does this broad bother them.

http://thehill.com/homenews/administration/320960-law-professors-file-complaint-on-conway-report

LikeLike

Let’s criminalize conservatism….

LikeLike

http://www.breitbart.com/big-hollywood/2017/02/24/ashley-judd-trump-election-worse-raped/

LikeLike