Vital Statistics:

| Last | Change | |

| S&P Futures | 2252.8 | 0.8 |

| Eurostoxx Index | 357.0 | 1.3 |

| Oil (WTI) | 50.1 | -0.9 |

| US dollar index | 93.0 | 0.6 |

| 10 Year Govt Bond Yield | 2.58% | |

| Current Coupon Fannie Mae TBA | 103 | |

| Current Coupon Ginnie Mae TBA | 104 | |

| 30 Year Fixed Rate Mortgage | 4.14 |

Stocks are flat this morning after the FOMC meeting yesterday. Bonds and MBS are up small.

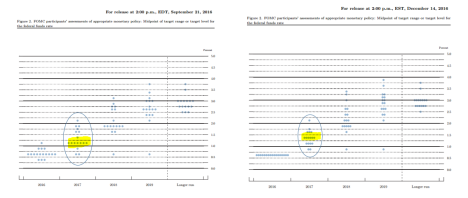

The Fed raised the Fed Funds rate a quarter of a point yesterday as expected, but the dot plot was what garnered all the attention. At the September meeting, the FOMC members were forecasting two more rate hikes in 2017, and now they are forecasting 3. That hit bonds, which sent the 2 year note yield up 12 basis points and the 10 year up 13 basis points. Overall, the language of the statement didn’t change much, and neither did the economic forecasts. Aside from a small uptick in their forecast for 2017 GDP growth, most everything else was the same. You can see the change in the central tendency for 2017 in the comparison of the dot plots below. September’s plot is on the right, and December is on the left. The yellow line represents the central tendency.

Due to the volatility, most lenders shut down their lock desks, so mortgage rates didn’t really move all that much, but expect to see at least some movement, although mortgage rates tend to lag the moves in the 10 year, sometimes quite substantially. The last few tightening cycles have seen a flattening of the yield curve, so an anticipated increase of 75 basis points in the Fed funds rate doesn’t necessarily translate into a 75 basis point increase in the 10 year. Mortgage rates will almost undoubtedly increase by less than the increase in the 10 year. And if rates are going up for the right reasons (economic growth) that means the purchase business should offset some of the losses of the refi business.

Janet Yellen’s press conference was largely a non-event. She spent it dodging questions about how Donald Trump looks at the world and stressed the Fed will remain data-dependent. The issue of productivity kept coming up, and how Trump will use policies to improve on it (via regulatory reform and corporate tax cutting). Productivity growth should translate into non-inflationary wage growth, which is what everyone is hoping for.

Bottom line: The Fed is going to fade into the background again, and Donald Trump will be driving the news cycle and bond yields. If Congress adds fiscal stimulus, the Fed will probably be more aggressive. Note the dot plot is only a forecast. In fact, many of those dots represent forecasts for people who are not voting members on the FOMC. The Fed might hike 3 times in 2017, but the 10 year yield probably won’t go up as much, and mortgage rates will go up even less.

Inflation at the consumer level increased 0.2% last month, and is up 1.7% YOY. The core rate (excluding food and energy) is up 0.2% MOM and 2.1% YOY. Healthcare and rent drove the increase.

We have some manufacturing data as well: Industrial production fell 0.4% MOM and manufacturing production fell 0.1%. Capacity Utilization was flat at 75%. The Philly Fed manufacturing index jumped to 22 from 10 and the Empire State Manufacturing Index improved to 9 from 6. Finally business inventories fell 0.2%.

Initial Jobless Claims fell 4k last week to 254,000. These are the lowest levels since the early 70s.

The median house price rose almost 8% in November, according to RedFin. According to their numbers, the median house price is 274k and months of inventory is 3.4 (meaning they see the inventory situation much tighter than NAR does in their existing home sales report).

Filed under: Economy, Federal Reserve, Morning Report |

Cross posted from PL to give them a reality check on their “Democrats are going to stand firm” BS.

Here’s a few indicators to look at between now and Trump’s inauguration about whether or not Democrats are actually willing to fight:

1. Seriously contest the Louisiana Senate runoff. Republicans got a lot of momentum from the Scott Brown upset, and with low turnout a real push to get out the Democratic vote could really make a difference.

Opps, looks like they already missed this one and they didn’t bother to have any national Democrats of any prominence show up.

2. Obama either requests Comey’s resignation or fires him. If he’s really a secret Russian agent actively pursuing a partisan agenda to undermine the US democratic election process, that’s about the least that can be expected. Sure Trump’s replacement might be worse, but at least he wouldn’t be Obama’s FBI Director.

3. Obama recess appoints Merrick Garland to the Supreme Court once Congress adjourns. If the Republican obstruction of his nominee is really beyond the pale and unprecedented, then that’s how you push back against it. Sure he only serves for one year, but it would do wonders to rally the dispirited Democratic base.

In all three of these cases, ask yourselves what Republicans would have done if the roles were reversed. I think everyone knows the answer, and that explains why Republicans win and Democrats don’t when it comes to political hardball.

And if Obama doesn’t do the last two, that just shows that Democrats don’t actually believe their own BS.

LikeLike

jnc:

Cross posted from PL to give them a reality check on their “Democrats are going to stand firm” BS.

Is this your comment or someone else’s?

LikeLike

Mine.

I was generously giving them an action plan, but I think they would rather be victims.

LikeLike

Do you really think R’s are more willing to play hardball than the D’s, or would be willing to embrace your plan in a way that D’s are not? Bush had plenty of judicial appointments held up by filibusters, but he never tried to recess-appoint them.

LikeLike

I think in general the Republicans are willing to force issues if they believe it will be a political winner and disregard what Democrats and crucially the MSM thinks more so than Democrats.

But I could have been trolling them a bit too given all the BS that’s been going around about how they are going to have to stand up to Donald Hitler.

If they really believe that, there were three things that they could do now.

LikeLike

Some Democrats in congress have to be looking at a Trump presidency as, at least potentially, an unparalleled opportunity to trade for pork, or shape the pork that’s already coming so it benefits his or her district or state. I’m not sure all of them are going to be all-in for non-stop battle, except perhaps when tossing red meat to the base in the media.

LikeLike

The meltdown on the left continues:

http://billmoyers.com/story/none-dare-call-treason/

LikeLike

Brent:

The meltdown on the left continues:

Anyone who uses the phrase “tax cuts for the rich” in a non-ironic way should be immediately ignored.

LikeLike

Really? And if the CIA determined Saddam Hussein was responsible for 9/11, he’d just repeat that as if it were holy writ delivered by Moses?

Not saying it didn’t happen, but I think it’s premature for anybody to say it’s “determined” until some actual data is available to them.

LikeLike

Although, honestly, as far as Moyers is concerned, that’s pretty par for the course. It’s not really a meltdown if that’s how you’ve always been.

LikeLike

Guess who’s back after a nice long 8-year slumber?

LikeLike

Brent:

Guess who’s back after a nice long 8-year slumber?

Anyone who thinks the left’s current posture towards Trump is a unique phenomenon can be quickly disabused of the notion by watching re-runs of Olbermann during the Bush years.

LikeLike

The response to Trump is in degree, not kind. What is unique is Trump, and the degree which he basically says: you don’t like that? Well, watch this.

He has no interest in responding to their critiques, except by doubling-down. And the MSM and critics on the left, generally, are clearly not used to that.

LikeLike

I’m assuming he no longer has a job somewhere that he needs to keep? So he can be a freelance loon?

I bet at some level Olbermann is so happy that Trump won.

LikeLike

I would stop reading the PL for any ACA repeal stuff. They’re not sourced on the R side and it’s showing in their coverage.

LikeLike

Politico probably is though. PL is just spinning other people’s reporting at this point.

LikeLike

of course not. that’s fake news, and who cares what the goobers think?

LikeLike

The media turns on itself.

“Fake news is a convenient scapegoat, but the big 2016 problem was the real news

You can’t blame Macedonian teens for disastrously email-centric coverage.

Updated by Matthew Yglesias

Dec 15, 2016, 10:00am EST”

http://www.vox.com/policy-and-politics/2016/12/15/13955108/fake-news-2016

LikeLike

Or maybe it’s all fake news. Glad he’s not worried about “disastrously Trum-Tweet-centric” or disastrously “p****y grabbing” centric coverage.

No doubt, all that super-positive press coverage Trump got helped turn the election for him.

LikeLike

Worth a note:

http://www.realclearpolitics.com/video/2016/12/14/rep_peter_king_almost_like_cia_is_carrying_out_a_disinformation_campaign_against_donald_trump.html

LikeLike

One of those red flags that would make a legitimate press question what the CIA was leaking to them, if they didn’t already love the narrative so much that it was “too good to question”.

LikeLike

Worth a read. I’d be interested in Brent & Scott’s take on this.

“Whistleblower Vindicated: Massive Trading Firm Knight Capital Charged With Abusing “Naked Shorts”

David Dayen

December 15 2016, 11:53 a.m.”

LikeLike

Naked shorting in the process of making a market is completely legal. If it is prop trading, it is not.

I suspect the issue is that Knight was facilitating a trade between an offshore client and an onshore client, and was net flat, however they were long in offshore account and short in the onshore account. That would explain the small fine, as they really don’t have any economic exposure.

Basically whenever people lose money on a stock, the natural impulse is to claim that market makers were manipulating the stock.

LikeLike

jnc:

Worth a read. I’d be interested in Brent & Scott’s take on this.

I am not an expert on the equity markets, but back in 2008/9 I remembering hearing from someone who would know that the SEC was very lax about enforcing rules and penalties on failure to deliver on equity sales. If that is true, this seems entirely plausible. It’s a bad thing. The penalty for a failure to delivery needs to be steep and sure, otherwise it allows for exactly what the author is suggesting, in effect the artificial manufacture of an unlimited about of new shares.

LikeLike

Hollywood comes to save us all! Former President Martin Sheen a some people from the TV show Mash I haven’t seen in 20 years are here to tell the Republican electors to vote against Trump!

It would have helped their argument if they understood that the point of the Electoral college was to avoid factional control over the nation, not prevent uncouth sorts from becoming president (this was the Hamiltonian argument, but wasn’t really the why of the electoral college). They also suggest that Hamilton created the electoral college, which he did not. Not to mention, Hamilton wanted a more King-like president and someone of the wealthy elite, and he would probably consider Trump an ideal president if not for his uncouth manners. Hamilton wanted an American caste system.

What they’re making is a Jeffersonian argument. It would help their case, I think, if they understood that, but weren’t desperate to evoke Hamilton because they like the show or something.

LikeLike

LikeLike

Slate’s going all in “if you don’t agree with us you’re a murderous racist” position. It’ll be interesting to see how that works out for them.

LikeLike

Do people really believe this?

https://twitter.com/1followernodad/status/809221868989214721

LikeLike

Nobody sane. But the people for whom everything in the world is about their personal hobby horse will always be with us.

LikeLike

The bubble. It’s not just for right wingers anymore.

LikeLiked by 1 person