Vital Statistics:

| Last | Change | |

| S&P Futures | 2162.0 | 16.0 |

| Eurostoxx Index | 338.8 | 3.0 |

| Oil (WTI) | 45.6 | 0.8 |

| US dollar index | 86.9 | -0.2 |

| 10 Year Govt Bond Yield | 1.53% | |

| Current Coupon Fannie Mae TBA | 103.2 | |

| Current Coupon Ginnie Mae TBA | 104.2 | |

| BankRate 30 Year Fixed Rate Mortgage | 3.47 |

Stocks are higher this morning after the Bank of England declined to cut interest rates. Bonds and MBS are down

Initial Jobless Claims fell to 254k in a holiday shortened week.

Consumer comfort increased last week to 44.7 from 43.5

Producer prices increased 0.5% in June, versus expectations of a 0.3% increase. On a YOY basis, they increased 0.3%. Higher energy prices drove the increase, however we are a long way from seeing true inflationary pressure. Inflationary pressure won’t build until we start seeing wage inflation, and there we have a dichotomy: Firms with highly skilled labor are having to raise wages to keep top talent, while technology is depressing wages for people in jobs that will eventually be replaced by robots and expert systems. Note the Fed’s Beige Book characterized wage growth as “modest to moderate.” This is Fed-speak for “almost imperceptible.” That said, wage growth appears to have broken free from post-crash 2% level and is beginning to register in the mid 2%s.

JP Morgan reported better-than-expected earnings this morning. Mortgage banking revenue was up 2% QOQ and 5% YOY. Portfolio growth and and production revenue increases were offset by lower servicing revenues. The stock is up 2.5% pre-market.

Has the big rally in prices for foreclosed homes run its course? RealtyTrac suggests that it may have, as more and more “mom and pop” investors are winning foreclosure auctions and the professionals are pulling back from the market. Professional investors accounted for almost 10% of all home purchases in the depths of the housing bust, now they account for about 2.5%. There are some fears that this signals another housing bubble. FWIW, home prices are stretched compared to incomes, however that ignores the effect low interest rates are having. Housing bubbles are rare things – prior to the 2006 bust the last bubble in real estate popped in the 1920s. Anyone reading this will probably never see another one.

Speaking of foreclosures, the people who got foreclosed on early in the housing bust basically missed out on about 10 years of house price appreciation. To add insult to injury, many sold into a cheap housing market (to the professional investors mentioned above) and moved into expensive rentals (managed by the professional investors above).

Earnings season has just started, and the S&P 500 is at record highs. Is this rally for real? It will depend on earnings, which have been declining the past several quarters. The other thing that will drive the market is share buybacks. With the world’s central banks driving down interest rates, they are lowering Corporate America’s cost of capital. Many companies are choosing to issue debt to retire stock. This move is essentially a no-brainer for corporate CFOs who don’t have much in the way of profitable expansion opportunities. When you can issue debt for 4% to retire stock with a cost of capital of 10%, you do it.

The flip side of ultra-low interest rates is a boring, risk-averse economy. This has been a conscious choice among policy-makers (remember “Make banking boring again”?). Of course a major problem is that usually global economies de-leverage after asset bubbles, but that hasn’t happened this time around. As global debt levels rise, they act as sand in the gears for the economy, slowing it down. Ironically, the policy-makers who drove this are concerned first and foremost about inequality, and the unintended consequence of their policy has been an economy that gooses asset prices and retards business formation (which means less jobs). This increases inequality even further – the opposite of what they intended.

Of course the endgame for these policies is Japan, which is discussing new fiscal measures to try and pull their economy out of a 25-year bust.

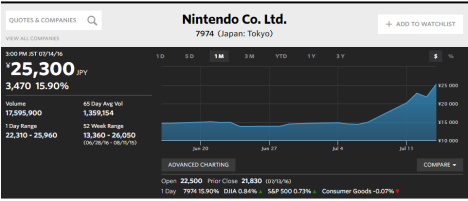

Speaking of Japan, do you have kids that are playing Pokemon Go? (the latest craze). This has really caught investors by surprise: Nintendo stock is up 76% over the past week.

Filed under: Economy, Morning Report |

Scott Adams on recent changes:

LikeLike

Perfect – Pokemon Go is the enemy of the Revolution.

https://www.jacobinmag.com/2016/07/pokemon-go-pokestops-game-situationist-play-children/

LikeLike

I see the little sisters of the poor are at it again.

LikeLike

The Founding Fathers never intended for people to have this sort of horsepower. It is time to ban assault trucks.

LikeLiked by 1 person

Interesting read on the source of progressive love for the minimum wage:

https://newrepublic.com/article/128144/dark-history-liberal-reform

The minimum wage, in addition to providing some workers with a better standard of living, would guard white men from competition. Leonard is worth reading at length:

If Leonard didn’t have the quotes from prominent progressives to back up his claims, this would read like right-wing paranoia: The state’s most innocuous protections reframed as malevolent and ungodly social engineering. But his citations are genuine. Charles Cooley, a founding member of American Sociological Association, warned that providing health care and nutrition for black Americans could be “dysgenic” if not accompanied by population control. The eugenicists weren’t just dreaming: Between 1900 and the early 1980s, over 60,000 Americans were involuntarily sterilized under the law.

LikeLike