Vital Statistics:

|

Last |

Change |

Percent |

|

|

S&P Futures |

1844.9 |

4.3 |

0.23% |

|

Eurostoxx Index |

3153.3 |

19.6 |

0.62% |

|

Oil (WTI) |

101.8 |

0.5 |

0.52% |

|

LIBOR |

0.233 |

0.000 |

-0.11% |

|

US Dollar Index (DXY) |

80.16 |

0.044 |

0.05% |

|

10 Year Govt Bond Yield |

2.68% |

0.00% |

|

|

Current Coupon Ginnie Mae TBA |

105.2 |

-0.1 |

|

|

Current Coupon Fannie Mae TBA |

104.2 |

0.0 |

|

|

RPX Composite Real Estate Index |

200.7 |

-0.2 |

|

|

BankRate 30 Year Fixed Rate Mortgage |

4.33 |

Stock markets in the US are following overseas markets higher. Bonds and MBS are flat

Personal Income and Personal Spending rose .3% month over month in February. January’s spending number was revised down. The core personal consumption expenditure growth rate was 1.1% annualized, showing inflation remains tame and gives the Fed leeway to keep interest rates low. For all the talk about “six months” and “considerable time” don’t forget that this Fed takes the dual mandate seriously and believes inflation can be too low. If inflation remains around 1%, they will want to pursue policies to push it closer to 2%. The Fed has been trying to create inflation for six years and the numbers remain stubbornly low.

Note that in response to recent data, Barclays has trimmed its estimate for Q1 GDP to 2% from 2.4%.

The latest CoreLogic Market Pulse is out, with a couple of good articles. First, it discusses how housing affordability differs between first time homebuyers and buyers with an existing home. Affordability has been declining, but it has been declining more for first time homebuyers, which may partially explain why the first time homebuyer remains on the sidelines. Until they return to the market, we are going to have this sort of abnormal market, IMO.

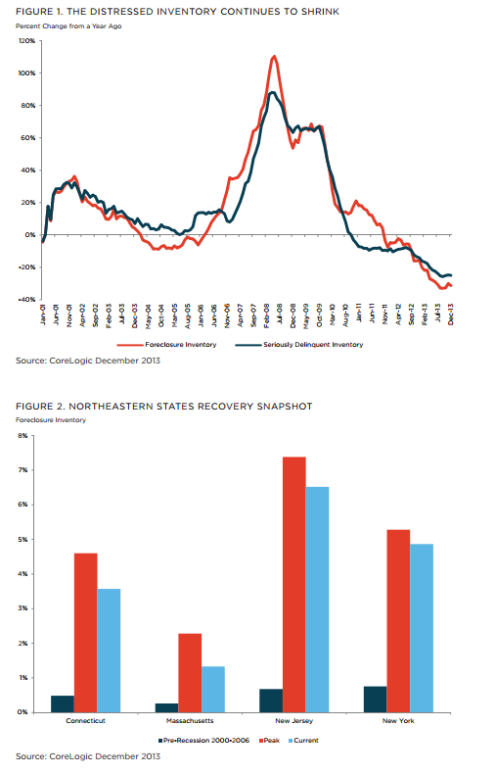

Foreclosure inventory is down 31% nationally from a year ago to about 837,000 homes. or about 2.1% of all homes with a mortgage. In states like California, professional investors snapped up the foreclosure inventory and at this point supply is constrained and prices are rising. Not so in the Northeast, where very little progress has been made on the foreclosure inventory, and unsurprisingly prices have barely budged.

Filed under: Morning Report |

Hah, frist!

I kept y’all distracted with food talk and snuck in!

LikeLike

Wicked! Good show, Lulu.

LikeLike

damn. i was slowed by pretzels and beer!

LikeLike

On rationing care: https://www.fraserinstitute.org/uploadedFiles/fraser-ca/Content/research-news/research/publications/private-cost-of-public-queues-for-medically-necessary-care-2014.pdf

LikeLike

I’m agnostic on wait times, since we all have wait times already (e.g., when I scheduled my colonoscopy a couple of years ago I would have had to wait six weeks for an opening, except it just so happened that they’d had a cancellation for one three days after I called–I imagine I skewed their statistics then), but any speculation on why Alberta has the highest average wage? Oil? The fact that Prince Edward Isle was the lowest didn’t surprise me.

I’m not sure that you can really compare percentage of population waiting for specialty procedures between provinces without knowing how many specialists per capita there are in a given province. Manitoba and Nova Scotia have the highest percentages of their population waiting (approximately twice the national average) but those are also very sparsely populated provinces. Without doing any research, off the top of my head I can only think of one major city in each (WInnipeg and Halifax), which may be where the only hospitals/providers for some of that care are located. Do you know of any reports that include those kind of statistics?

Don’t spend a lot of time on that–I’m just mildly curious.

LikeLike

Hello All Just a couple quick comments.

Re: Splitting of the country – My husband and I are seriously considering moving to Ajijic, Mexico once my disability is approved AND we finally settle on our inverse condemnation case (which is already years old SIGH). We’ll keep our U.S. citizenship. But I’ll be able to get my neck and lower back fixed and not have to end up paying either 20% of the more than $200k (just for neck) or have to pay an additional estimated $150/mo extra for a supplement (which Roger will also have to do as soon as my disability is approved as VA will then drop him)… having to pay an extra estimated $300/mo for us both in addition to the $210/mo or so for Medicare.. that’s a huge hit on fixed incomes. Adding in the all-around much lower cost of living, we’ll actually be able to retire comfortably (with maid and gardener) which is something that just won’t happen here in our very expensive U.S. of A. Hell, we’ll be able to afford traveling back and forth and live our senior years out in a place that is so much like a permanent tropical vacation.

Re: Obesity and Grains – we eat mostly protein and veggies – we rarely eat grains other than the occasional pizza once every 3 months or so. And Roger is so much happier and healthier since he quit drinking last April when an ambulance trip to the ER turned out to be severe pancreatitis.

OH, almost forgot to mention RE my disability claim…. judicial review group gathered all records and posted them on their intranet for my attorneys to review. Attorneys done and have sent back to the group. We are now awaiting either approval by the group, or, the setting of the court date to appear before the judge. We are finally getting somewhere.

OH again LOL… an update on working with Chase to get a forbearance and prevent a possible foreclosure IF the SSA delays my disability approval. We learned that since Chase denied our forbearance “due to not having been a Chase customer long enough”, even though they have held our mortgage since March ’08, that all we need to do is immediately open another request for a forbearance. Doing so prevents Chase from bringing foreclosure proceedings (new law beginning Jan 1 of this year). While we currently are only 1 month in arrears (simply couldn’t pay Feb until Mar so Mar will be paid in Apr), depending on how long SSA takes, we could end up 2 months in arrears. But we fear not since we now know all we have to do is open a new request for a forbearance every time we are denied until my disability is approved and I receive my retro check which will easily be way more than enough to even pay a years worth of mortgage payments 🙂

And with all that, have a really good day All! I’ll keep up to date with you via reading all the emails I get from ATiM and will continue to respond on days where I have control of my pain(s).

LikeLike

Hi, Geanie–

Isn’t bureaucracy great? Glad you’ve found a way to get around the Chase dilemma, although it’s a pain that you had to do that.

LikeLike

Geanie, glad you are making progress on the disability claim. With regards to the foreclosure, have you talked to a bankruptcy lawyer to investigate your options if necessary?

LikeLike

JNC.. We don’t even want to consider bankruptcy since our financial hardship is only temporary (waiting on disability approval). We had enough in savings and help from family to get us to the end of last year (an entire year). It’s true what they say, a disabled person waiting for SSDI approval has a very good chance of going broke and filing bankruptcy. IMHO, once your doctor AND the doctor SS sends you too both say you are disabled, it should be a done deal, not this long drawn out process which forces many middle class citizens into the lower, poverty class.

LikeLike

Updated CBO score of the PPACA:

http://www.cbo.gov/publication/45159

LikeLike

is that what I posted the other day?

LikeLike

Nova, it may be. I might have missed it the first time.

Geanie, that makes sense. However if you really are threatened with a foreclosure I’d suggest at least getting a consultation about a Chapter 13 bankruptcy, which typically allows you to protect assets.

http://en.wikipedia.org/wiki/Chapter_13,_Title_11,_United_States_Code

LikeLike

Jnc… yea, we’re good for now as long as we can continue applying for a forbearance. And I’m feeling very good about a speedy end to this SSDI crap. But, if worse comes to worse, oh yea, we’ll seek a bankruptcy attorney… after all, isn’t that the norm here in America for those with disabilities to have to watch their credit ratings go down and file bankruptcy before they get approved.

LikeLike

“And I’m feeling very good about a speedy end to this SSDI crap”

That’s good news.

LikeLike

He should be taxed at 99%, no? If not, why not?

http://www.finalternatives.com/node/26589?utm_source=feedburner&utm_medium=twitter&utm_campaign=Feed%3A+Finalternatives+%28FINalternatives+Hedge+Fund+News%29

LikeLike

This is hilarious:

http://www.slate.com/blogs/weigel/2014/03/28/stephen_colbert_versus_the_hashtag_activists.html

LikeLike

I believe this to be true. Do others disagree?

LikeLike

McWing:

I believe this to be true. Do others disagree?

Definitely true. It is why the typical progressive response (“More cowbell!”) to their concern about monied interests influencing government is so self-defeating.

LikeLike

“You can laugh at being told to “check your privilege,” but hearing that plants an idea that you can’t shake”

HA! what. I’m supposed to carry that for forever. whatever.

LikeLike

Are college scholarships considered taxable income?

LikeLike

It depends on the scholarship. If it’s a public college, the scholarship is non-taxable if it’s used for tuition, books, fees, etc. However, it is taxable for non-required books, housing, food, transportation, etc. Also it is taxable if used at a private college.

LikeLike

McWing:

See this from Schwab. Doesn’t seem like there is a public/private difference.

LikeLike

I stand corrected. I mis-read what I read. Scholarships to private colleges follow the same rules as public colleges. I stand by the rest of my statement.

LikeLike

Geanie:

Scholarships to private colleges follow the same rules as public colleges.

The only reason I even checked was because I was pretty surprised (and about to be outraged) that they were treated differently. Happily, they are not.

Of course, if we taxed consumption rather than income, as we should, these types of distinctions would never arise.

LikeLike

Thanks Geanie!

LikeLike

Worth a read:

“Forces of Divergence

Is surging inequality endemic to capitalism?

by John Cassidy

March 31, 2014 ”

http://www.newyorker.com/arts/critics/books/2014/03/31/140331crbo_books_cassidy?currentPage=all

LikeLike

Thanks to both of you. Great info.

LikeLike

Curious. How’d the question come up, McWing?

LikeLike

Well, it just occurred to me that scholarships (I was never smart enough to get any) are a real financial benefit and I figured they’d be taxable. But then, I’ve never seen that confirmed anywhere so I thought I’d ask here, assuming someone would know cause they either received or new someone who received one. That’s all, simple curiosity.

LikeLike

I knew because that’s how I went to college, excluding my first semester. I didn’t attend college until after 5 years after H.S. graduation While I was smart enough to get multiple scholarships per semester following my first semester, evidently I was stupid enough to think my H.S. transcript, after 5 years, meant nothing. I, of course, discovered too late that it would have gotten me scholarships for my first semester as well. I am also listed in the Who’s Who Among Junior Colleges… yep, I had an awesome 31 year career thanks to my 2 Associate degrees; accounting and computer science.

Although, along with my stupidity of not realizing my H.S. transcript would have provided me with scholarships right off the bat, the fact that I actually turned down a 4 year all-inclusive scholarship to attend Tulsa University because my boyfriend (1st husband) didn’t want me to attend college (he said it was either him or college as his wife would never work), doesn’t seem to provide any substance to my smartness. Hindsight, Hindsight, Hindsight!

LikeLike

” (he said it was either him or college as his wife would never work),”

I have family member who stopped a few credits shy of her PhD because her husband didnt’ want to be Dr. and Mr. X

they’re both dead for few years now, but when I heard about that, it was just WTF!

LikeLike

Full fledged “more PC than thou” meltdown at Salon.

“Stephen Colbert is a white man and that means there have to be boundaries.”

http://www.salon.com/2014/03/28/in_support_of_cancelcolbert_why_stephen_colbert_needs_to_make_this_right/

LikeLike

Re: jnc’s link.

satire’s dead, right? i mean, it had a good run. but it’s over.

LikeLike

I don’t know if I can handle that link after the “I hate white belly dancers” one!

LikeLike

This cracked me up. NoVA, does NoVA, Jr have plastic dinosaurs?

LikeLike

“Stephen Colbert is a white man and that means there have to be boundaries.”

Which is why I avoid racial discussions like the plague, and cringe every time obama says we need to have a discussion on race.

LikeLike

I enjoy my white privelage and respect no boundaries.

LikeLike

*mic drop*

LikeLike

I’m guessing that the correct pronunciation is “priv-eh-lige” with three distinct syllables? 🙂

LikeLike

From Aviation Week on tracking the flight:

http://www.aviationweek.com/Article.aspx?id=/article-xml/awx_03_24_2014_p0-674902.xml&guid=2014-03-24

also:

http://www.aviationweek.com/Article.aspx?id=/article-xml/awx_03_25_2014_p0-675203.xml&guid=2014-03-25

The 10 lessons are good advice at any age. Perhaps risk taking must be curtailed at some point…but I digress.

LikeLike

How ’bout that?! Both UM and MSU in the Elite Eight–and in nailbiters of games.

And Wisconsin is still in the hunt as well. . . the BiG is rocking this year!

LikeLike

I put a weekend post up.

LikeLike